简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What WikiFX Found When It Looked Into Vestrado

Abstract:When evaluating a forex broker, regulation and transparency are crucial indicators of trustworthiness. Unfortunately, not all brokers meet these essential standards. Vestrado, a trading platform currently operating in the global forex market, presents several concerning issues that traders should not ignore.

Vestrado claims to operate under the license of South Africas Financial Sector Conduct Authority (FSCA). While it does hold License Number 51891, its regulatory status is flagged as “Exceeded”, which means Vestrado operates beyond the authorized business scope of this license. This type of status often signals potential misuse or misrepresentation of licensing, which should immediately raise caution among traders. The FSCA is generally known for enforcing rigorous standards in the financial sector, but exceeding the licensed scope undermines that protection and calls into question the broker's integrity.

In addition to the FSCA, Vestrado is registered in Saint Vincent and the Grenadines (SVG), that is a jurisdiction well known for lax or virtually nonexistent oversight of forex and CFD brokers. SVG allows businesses to register with minimal regulatory hurdles, making it a hotspot for firms looking to avoid the scrutiny imposed by more serious financial authorities. While legal, this registration provides no meaningful protection to traders. When combined with the exceeded scope of the South African license, this dual-status points to a relatively higher-risk broker profile.

Operating from SVG with a questionable licensing status aligns with patterns seen in scams, where brokers present a facade of legitimacy while avoiding actual accountability. Without a credible regulatory body to hold the company responsible, users risk falling into traps such as withdrawal denials, account deactivation, or sudden changes in trading terms.

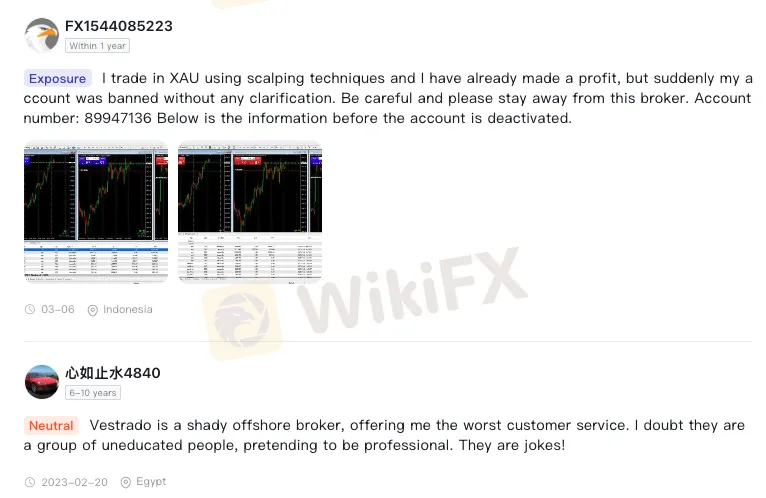

In addition to the regulatory gap, Vestrado has also received a few complaints from users. These unresolved issues can create trust concerns and may indicate weaknesses in customer support or ethical business operations.

The 2.19/10 WikiScore confirms the operational red flags surrounding Vestrado. This score reflects a poor overall evaluation of the brokers infrastructure, including software performance, customer support, business transparency, and most importantly, regulatory adherence.

Traders are strongly advised to exercise caution when selecting a broker. Always perform independent verification of a brokers regulatory status and licensing history. With the growing prevalence of forex scams, staying informed is your first line of defense.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Startling Differences Between Hedging and Arbitrage

The two risk management investment tools - hedging vs arbitrage - have been helping investors achieve their respective financial goals. Explore this comparision to understand their functionalities, the investment purpose they serve, the risk attached, and several other aspects.

Why Octa Is the Ideal Broker for MetaTrader 4 & 5 Users

Octa is a well-reputed, renowned, and award-winning broker in the forex market. It offers many exclusive features to investors, such as educational resources, a wide range of assets, dedicated customer support, and access to popular trading platforms like MetaTrader 4 and 5.

Dubai Police Arrests 4 People in Connection with High and Quick Profits Online Trading Scam

Dubai Police have arrested four individuals involved in defrauding many investors via fake online trading schemes that promised high and quick returns. Check out the arrests, international connections, and more in this story.

Spanish Regulator, CNMV Alerts Investors against 11 Scam Brokers

Spain’s Financial regulator, CNMV (Comisión Nacional del Mercado de Valores) CNMV has issued warnings against 11 forex brokers operating without proper authorization.

WikiFX Broker

Latest News

What WikiFX Found When It Looked Into Vestrado

Is the Forex Bonus a Genuine Perk or Just a Gimmick?

eToro Joins Hands with Premiership Women’s Rugby

OctaFX Was Fined $37,000 for Operating Without a License

Hantec Financial: A Closer Look at Its Licenses

Saxo Bank Fined €1 Million by AMF Over Compliance Failures During IT Migration

CySEC Flags Two Unlicensed Investment Platforms: greymax.net and finotivefunding.com

Hantec Markets Appoints New Executives for Growth in Dubai

Olymptrade Under Fire – Fraud Allegations and Investor Outrage

GoPro, Krispy Kreme join the meme party as Wall Street speculation ramps up

Currency Calculator