简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

UK government borrowing falls in June

摘要:UK government borrowing falls in June

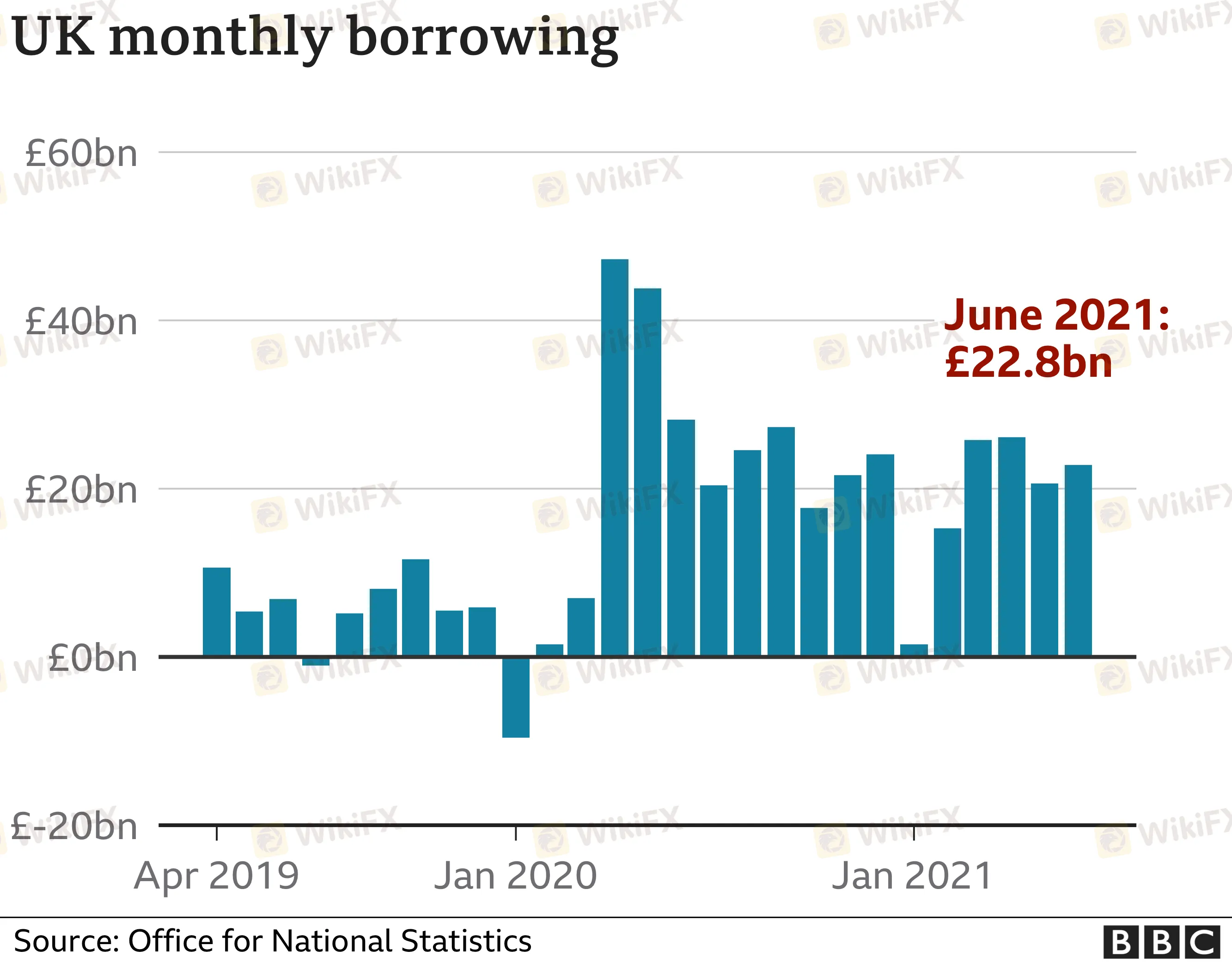

Government borrowing fell in June compared with the same month last year, with the economy in recovery mode after lockdown measures eased.

Borrowing - the difference between spending and tax income - was £22.8bn, official figures show, which was £5.5bn lower than June last year.

However, the figure was the second-highest for June since records began.

Borrowing has been hitting record levels, with billions being spent on measures such as furlough payments.

The huge amount of borrowing over the past year has now pushed government debt up to more than £2.2 trillion, or about 99.7% of GDP - a rate not seen since the early 1960s.

Where does the government borrow billions from?

The Office for National Statistics (ONS) now estimates that the government borrowed a total of £297.7bn in the financial year to March.

That was 14.2% of the UK's GDP and the highest level since the end of World War Two.

The ONS said the cost of measures to support individuals and businesses during the pandemic meant that day-to-day spending by the government rose by £204.3bn to £942.7bn last year.

In response to the latest figures, Chancellor Rishi Sunak said he was “proud of the unprecedented package of support we put in place to protect jobs and help thousands of businesses survive the pandemic”.

He added: “However, it's also right that we ensure debt remains under control in the medium term, and that's why I made some tough choices at the last Budget to put the public finances on a sustainable path.”

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

知名外匯券商FBS獲頒2025最佳交易條件大獎

香港券商金祥國際再爆交易糾紛!投資人控獲利遭惡意回撤,強行刪除帳戶惹爭議

SkyLine Guide 2025 Malaysia:百位權威評委集結完畢

請小心高風險平台Genixprotrading!遭英國FCA示警、網站無法連線疑爆雷

交易的真相,藏在人性裡

職業交易員與散戶的根本差異

Trendscentre遭加拿大CSA列入示警名單,缺乏監管、網站失效,疑似已潛逃

匯率計算