简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

UK government borrowing falls in June

摘要:UK government borrowing falls in June

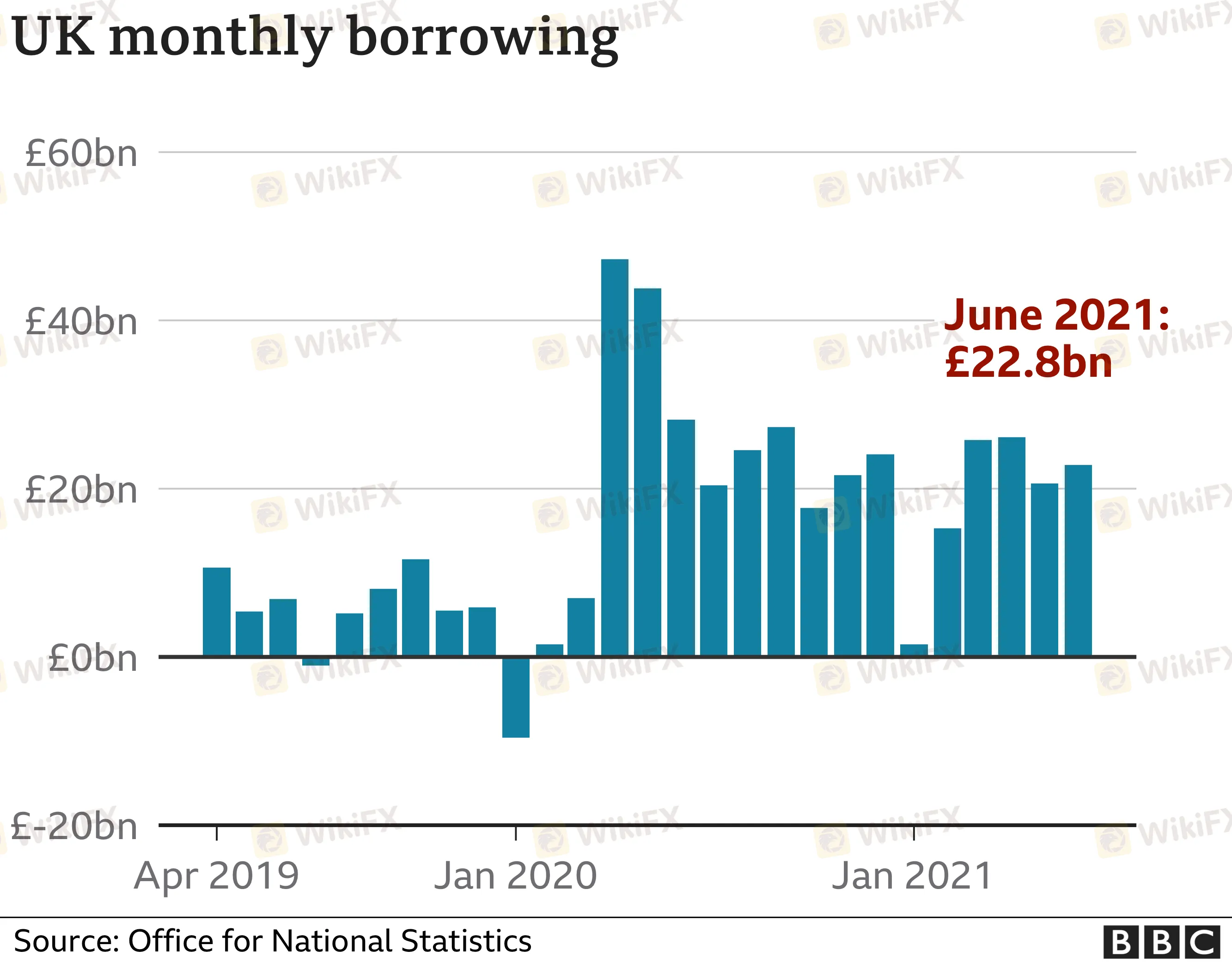

Government borrowing fell in June compared with the same month last year, with the economy in recovery mode after lockdown measures eased.

Borrowing - the difference between spending and tax income - was £22.8bn, official figures show, which was £5.5bn lower than June last year.

However, the figure was the second-highest for June since records began.

Borrowing has been hitting record levels, with billions being spent on measures such as furlough payments.

The huge amount of borrowing over the past year has now pushed government debt up to more than £2.2 trillion, or about 99.7% of GDP - a rate not seen since the early 1960s.

Where does the government borrow billions from?

The Office for National Statistics (ONS) now estimates that the government borrowed a total of £297.7bn in the financial year to March.

That was 14.2% of the UK's GDP and the highest level since the end of World War Two.

The ONS said the cost of measures to support individuals and businesses during the pandemic meant that day-to-day spending by the government rose by £204.3bn to £942.7bn last year.

In response to the latest figures, Chancellor Rishi Sunak said he was “proud of the unprecedented package of support we put in place to protect jobs and help thousands of businesses survive the pandemic”.

He added: “However, it's also right that we ensure debt remains under control in the medium term, and that's why I made some tough choices at the last Budget to put the public finances on a sustainable path.”

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

热点资讯

SkyLine Guide 2025 Malaysia :百位权威评委集结完毕

外汇监管风险预警! 这些平台被撤销牌照或无牌、套牌、超限经营

这15个黑平台受害者有机会申请索赔 “月入100亿”下单就爆仓

外汇小散 也能打盘?网友:笑到扶墙,侮辱智商

汇率计算