简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Outlook: USD Upside Stalling, Risk of Larger Setback

Lời nói đầu:USD Losing its Appeal Temporarily Eyes on August and March Peaks for Support

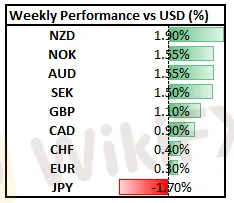

As risk appetite remains buoyant and while commodity prices continue to soar, the US Dollar has somewhat lost some of its appeal, with the greenback losing out to major counterparts across the board, excluding the Japanese Yen. That said, with the USD ending its streak of five consecutive weekly gains, markets appear to be long of dollars, which in turn raises the risk of greater unwind heading into next week, should risk appetite remain firm. On a technical note, as the USD index oscilates around the 94.00 handle, the weekly close is important, where a close below 94.00 may keep pressure on the downside.

Individual narratives have been popping up over the past week, which in turn has taken some of the attention away from the USD. This has ranged from BoE tightening bets for the Pound, JPY weakness stemming from higher commodities and bond yields, while the AUD has been helped along by Chinas energy crunch induced coal buying, alongside the breakout in copper.

Looking into next week, with little on the economic calendar besides flash PMIs, risk appetite will likely dicate the state of play across the FX space. A reminder that, markets remain fickle in the current environment and thus choppy seas can be expected, besides cross-JPY.

A NOTE ON THE JAPANESE YEN….

As oil prices trade at 3yr highs, oil-importing currencies such as the Japan Yen will continue to remain weak. Therefore, looking to fade Yen weakness is the equivalent of standing in front of the proverbial freight train. Meanwhile, momentum indicators such as the RSI showing that Yen crosses are in overbought territory, although, this is by no means at extreme levels and thus doesnt indicate that a reversal is imminent.However, I will be keeping a close eye for a pullback in oil and yields for a sign of a short-term top, alongside a dip in risk appetite.

USD TECHNICALS

Taking a look at the chart, the USD has posted a very slight bearish RSI divergence, typically a sign that upside momentum is stalling and thus leaves the greenback at risk of a larger setback. In terms of notable support, this lies at the August and March peaks at 93.73 and 93.44 respectively.

US DOLLAR CHART: DAILY TIME FRAME

Miễn trừ trách nhiệm:

Các ý kiến trong bài viết này chỉ thể hiện quan điểm cá nhân của tác giả và không phải lời khuyên đầu tư. Thông tin trong bài viết mang tính tham khảo và không đảm bảo tính chính xác tuyệt đối. Nền tảng không chịu trách nhiệm cho bất kỳ quyết định đầu tư nào được đưa ra dựa trên nội dung này.

Sàn môi giới

ATFX

Pepperstone

KVB

Exness

FXTM

FBS

ATFX

Pepperstone

KVB

Exness

FXTM

FBS

Sàn môi giới

ATFX

Pepperstone

KVB

Exness

FXTM

FBS

ATFX

Pepperstone

KVB

Exness

FXTM

FBS

Tin HOT

BOT Forex hoạt động như thế nào? Giải thích chi tiết từ A–Z

WikiFX Demo Trading - Tài khoản 100.000 USD vốn ảo miễn phí cho nhà đầu tư

Cổ phiếu Tesla lao dốc hàng trăm tỷ USD vì căng thẳng chính trị – Thị trường phản ứng ra sao?

Phanh phui sự thật đằng sau Immediate Luminary và cái bẫy 'biến 6 triệu thành 1 tỷ'

Đàm phán thuế quan và 'cành ô liu' - Bước ngoặt cho thị trường đã đến?

6 cách tra cứu sàn Forex nhanh chóng tránh bị lừa – Bài học từ một sàn đã bị triệt phá

Khởi tố 5 bị can trong vụ án lừa đảo hơn 10.000 tỷ đồng tại sàn tiền ảo Matrix Chain

Fed giữ nguyên lãi suất trước áp lực lạm phát gia tăng

Fusion Markets là ai? Phân tích giấy phép hoạt động của sàn Forex mới nổi này

Chiến dịch chia sẻ toàn cầu – Cơ hội PR miễn phí và nhận thưởng!

Tính tỷ giá hối đoái