Asian Stocks Mixed As US, Iran Trade Accusations Over Tanker Attacks

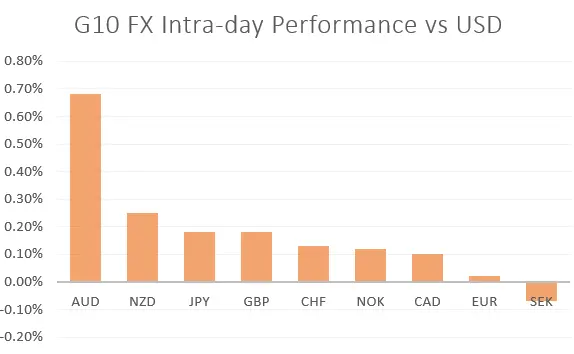

Regional equity had a narrow and mixed session Friday with Middle Eastern tensions back to the fore. Pro-risk currencies struggled much more obviously.

AUD Bulls Cant Count on the RBA, But Iron Ore Prices May Slow Its Fall

The Australian Dollar will struggle with low interest rates for a long time to come, but rising iron ore prices will counter at least some of their effects.

AUD Market May Find Bar To Deeper Rate Cuts Very High Indeed

The Australian Dollar market has already seen one rate cut, and its betting on at least one more. It may get that one, but the bar to deeper reductions could be higher than investors think.

Asian Stocks Hit Again By US-China Trade Worries, Treasury Yields

Most Asia Pacific mainboards were hit again after another Wall Street slide. South Korea s Kospi managed to buck the trend, though, with tech stocks bought.

AUDUSD Soars on Shock Election, Apple Shares Slump, Risk of S&P 500 Drop - US Market Open

AUDUSD Soars on Shock Election, Apple Shares Slump, Risk of S&P 500 Drop - US Market Open

HSBC Results Smash Forecasts, Asian Markets Focused On US Payrolls

The London-based global banking giant seems to have had success with cost cutting and growing its key Asian businesses. Market closures may have blunted the results effects

Australian Dollar Slides On Building Approvals Miss, RBA Looms

The Australian Dollar was hit by news that domestic building approvals slumped last month. The chance of lower Australian interest rates last week remains very much in play.

EURUSD at Risk of Breakout, AUDUSD Drops as Soft CPI Fuels RBA Rate Cut Bets - US Market Open

EURUSD at Risk of Breakout, AUDUSD Drops as Soft CPI Fuels RBA Rate Cut Bets - US Market Open

ASX 200 Holds Up On Australian CPI Miss, Other Asian Stocks Slip

Asia Pacific stock markets broadly failed to hang on to their gains despite Wall Streets punchy Tuesday. Weak Australian inflation boosted the ASX but hit AUD hard

USD Back on the Throne, EUR Drops, GBP Bounces Off Support - US Market Open

USD Back on the Throne, EUR Drops, GBP Bounces Off Support - US Market Open

S&P 500 Sinks with Health-Care Stocks as NZD/USD Could Reverse

The S&P 500 closed lower as health-care stocks dragged and triggered risk aversion after key resistance held. NZD/USD may reverse as the Australian Dollar rises on a jobs report.

Currency Volatility: AUDUSD Price at Risk Ahead of Aussie Jobs Data

AUDUSD overnight implied volatility soars to a multi-month high following the latest monetary policy minutes from the RBA which labeled future weakness in Australia's labor as a potential trigger to cut interest rates.

Australian Dollar Wilts On RBA Minutes, Jobless Data Could Be Key

The Australian Dollar faded on the release of minutes showing the RBA apparently in agreement with futures markets on a rate cut being more likely than a rise now

USDCAD Support Held on Negative BoC Business Outlook, AUD Eyes RBA

The Canadian Dollar fell as BoC business outlook resulted negative, fueling interest rate cut expectations as USD/CAD support held. Ahead, AUD/USD may fall to support on RBA minutes.

Aussie Price Outlook: Australian Dollar Breakout Faces First Test

Aussie is top performer against the US Dollar this week with the price breakout now at testing resistance targets. Here are the levels that matter on the AUD/USD charts.

S&P 500 Uptrend Eyed, Risks for AUD/USD Tilted to Upside on RBA

The S&P 500‘s uptrend carried on as markets focused on upbeat US ISM Manufacturing PMI data. Ahead, the risks for AUD/USD are tilted to the upside on April’s RBA rate decision.

GBPUSD Fell, Another Vote on Brexit Deal Blocked. AUDUSD May Rise

GBP/USD fell more after it emerged that a third vote on Theresa Mays Brexit deal could be blocked. Risks for AUD/USD may be tilted to the upside on RBA minutes as Japanese Yen weakens.

Australian Dollar Dives As Westpac Consumer Confidence Pulls Back

The Australian Dollar has already been hit this week by signs of fading business confidence, now consumers have joined the corporate sector in the doldrums.

GBP/USD No-Deal Brexit Rally Lacks Momentum, AUD Eyes China Data

GBP/USD‘s best gain in almost two years, as UK’s Parliament rejected a ‘no-deal’ Brexit, lacks upside momentum. AUD/USD may be torn between soft Chinese data,

EUR/USD Shrugs Powell Interview - Eyes German Data, US Retail Sales

After being battered by the ECB, EUR/USD will be watching todays release of German industrial production and US retail sales data.