简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

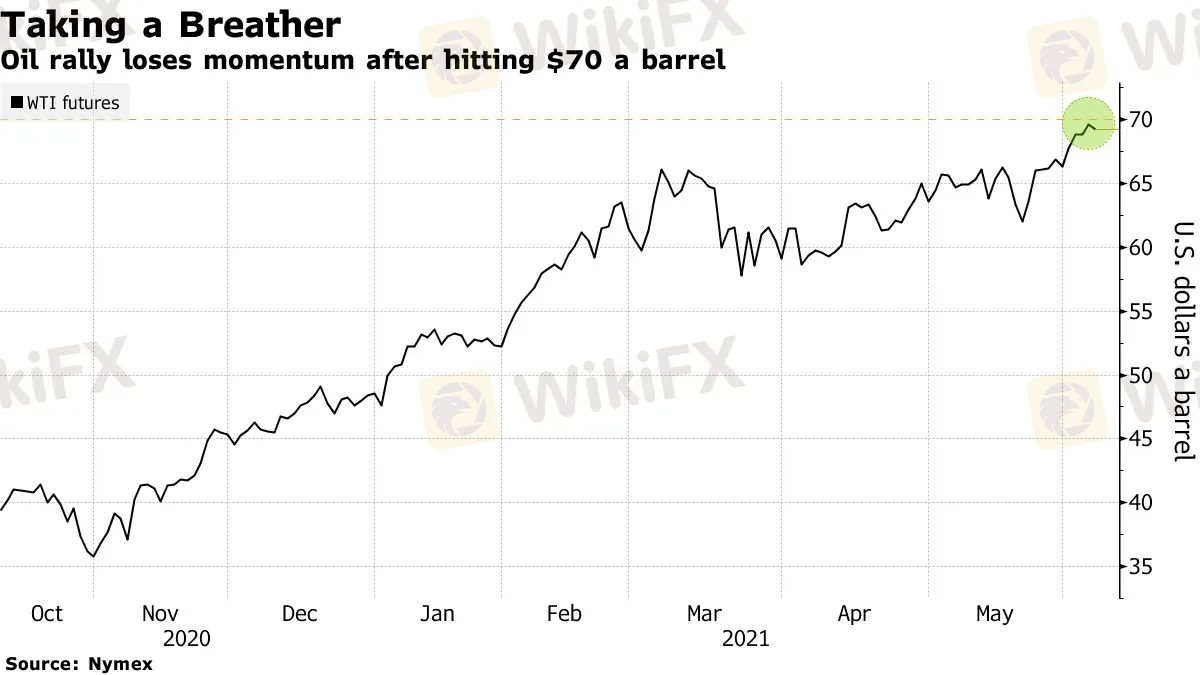

Oil Extends Drop With Rally Pausing After Bouncing Off 2018 High

Özet:BP predicts strong demand recovery; European traffic climbs WTI crude futures decline 0.8% after falling 0.6% on Monday

Oil extended declines in Asian trading after a rally that saw it hit $70 a barrel for the first time since October 2018 faltered.

Futures in New York dropped back below $69 a barrel on Tuesday after closing 0.6% lower in the previous session. While prices have eased, theres confidence in the demand outlook as vaccination rates accelerate and mobility climbs. BP Plc is predicting a strong recovery, and traffic in a number of European cities was as busy as in 2019 for the first time since the pandemic.

“It‘s just a case of gains being too quick, there is some profit-taking now,” said Howie Lee, an economist at Oversea-Chinese Banking Corp. “I don’t put too much weight on the drop. The market is still headed in an upward trend.”

Crudes advance from the worst of the virus has stalled a handful of times this year, but prices have managed to return to an upward track as overall global demand keeps improving. The Covid-19 comeback in Asia and parts of Latin America is a reminder that the rebound will be bumpy, however.

The market is also watching for any progress between Iran and world powers to revive a nuclear deal, which will likely see the removal of U.S. sanctions and increased Iranian crude flows. Discussions are entering a decisive phase, according to the agency monitoring Tehrans atomic sites.

PRICES

West Texas Intermediate for July delivery fell 0.8% to $68.70 a barrel on the New York Mercantile Exchange at 9:39 a.m. Singapore time after falling 0.6% in the previous session.

Brent for August settlement was down 0.8% at $70.94 on the ICE Futures Europe exchange after losing 0.6% on Monday.

Brent remains in a bullish market structure, despite the drop in headline prices. The prompt timespread for the global benchmark oil was 39 cents a barrel in backwardation -- where near-dated contracts are more expensive than later-dated ones. That compares with 40 cents on Friday.

Theres a lot of evidence that suggests that demand will be strong and that U.S. shale producers will remain disciplined, BP Chief Executive Officer Bernard Looney told Bloomberg in St. Petersburg, Russia. His comments echo those of other industry executives encouraged by a robust rebound in key nations.

Feragatname:

Bu makaledeki görüşler yalnızca yazarın kişisel görüşlerini temsil eder ve bu platform için yatırım tavsiyesi teşkil etmez. Bu platform, makale bilgilerinin doğruluğunu, eksiksizliğini ve güncelliğini garanti etmez ve makale bilgilerinin kullanılması veya bunlara güvenilmesinden kaynaklanan herhangi bir kayıptan sorumlu değildir.

WikiFX Broker

Kur Hesaplayıcı