简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Analysis: Crucial Resistance in Focus as Investors Eye FOMC Minutes

요약:Gold Price Analysis: Crucial Resistance in Focus as Investors Eye FOMC Minutes

Gold Price Analysis and Talking Points:

Gold Buying Persists, Eyes on FOMC Minute

Crucial Technical Resistance May Spark Inflection Point

See our quarterly gold forecast to learn what will drive prices throughout Q1!

Gold Buying Persists, Eyes on FOMC Minute

Since the beginning of the year, Gold prices are up over 5%, trading at its highest level since April 2018 as global central banks take a more accommodative stance. Most notably the Federal Reserve who emphasized that not only would they be patient in rate hikes, they had also opened up to the idea that the balance sheet unwind may end sooner than what the markets expects. Consequently, investors have flocked to the non-yielding precious metal. Eyes will be on tonights FOMC minutes, whereby a dovish release could see gold push towards key resistance at $1350.

However, judging by the price action observed in the USD and gold yesterday, markets may have already positioned themselves for a dovish outcome, implying a slight near-term pullback if markets perceive the minutes as less dovish than expected. Outlook continues to remain bullish as global bond yields continue to dip.

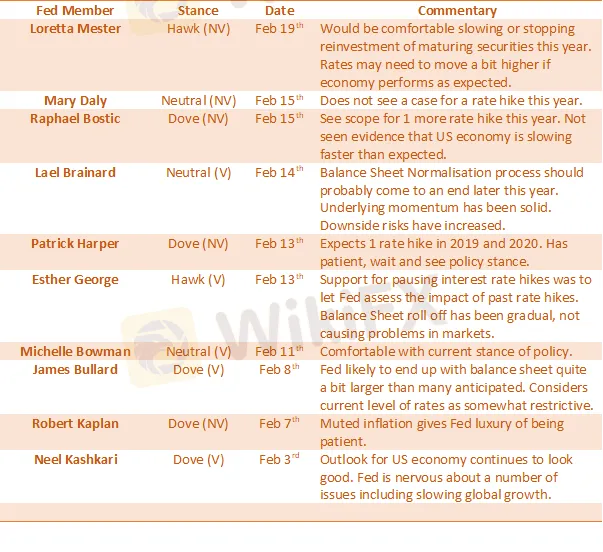

FOMC Tracker

Crucial Technical Resistance May Spark Inflection Point

With the gold uptrend firmly intact, the precious metal is now eying key resistance at $1350, which marks the descending trendline from the August 2013 peak, potentially sparking a near-term pullback. However, a closing break above increases scope for a move towards the 2018 peak at $1365-66. Elsewhere, a slight negative divergence on the RSI also raises the potential for a pullback.

GOLD PRICE CHART: Daily Time-Frame (Jun 2018-Feb 2019)

Chart by IG

GOLD PRICE CHART: Weekly Time-Frame (Aug 2010-Feb 2019)

RECOMMENDED READING

Gold Price Analysis: Fed Capitulation & Central Bank Buying Spree Maintains Bullish Outlook

What You Need to Know About the Gold Market

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기