简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Eurozone Faces Grim Economic Situation

एब्स्ट्रैक्ट:Although European countries have taken measures to deal with the epidemic, the market outlook remains grim.

Although European countries have taken measures to deal with the epidemic, the market outlook remains grim.

The European Central Bank pledged to purchase more than 1 trillion euros of assets this year to alleviate the impact of the epidemic, and governments have proposed hundreds of billions of dollars in spending plans to support businesses and workers.Yet despite all these initiatives, Eurozone remains in a severe recession. A survey conducted on April 14-22 showed that the economy of Eurozone shrank by 3.1% in the first quarter and is projected to shrink 9.6% in the second quarter.

The industry believes that the European Central Bank's easing policy is not over, and it will have to start buying ETFs like the Bank of Japan. The European Central Bank's balance sheet indicates that the central banks debt level currently sits at about 5.3 trillion euros; while expected to reach 6.2 trillion euros by the end of 2020 and further expand to 6.7 trillion euros by the end of 2021.

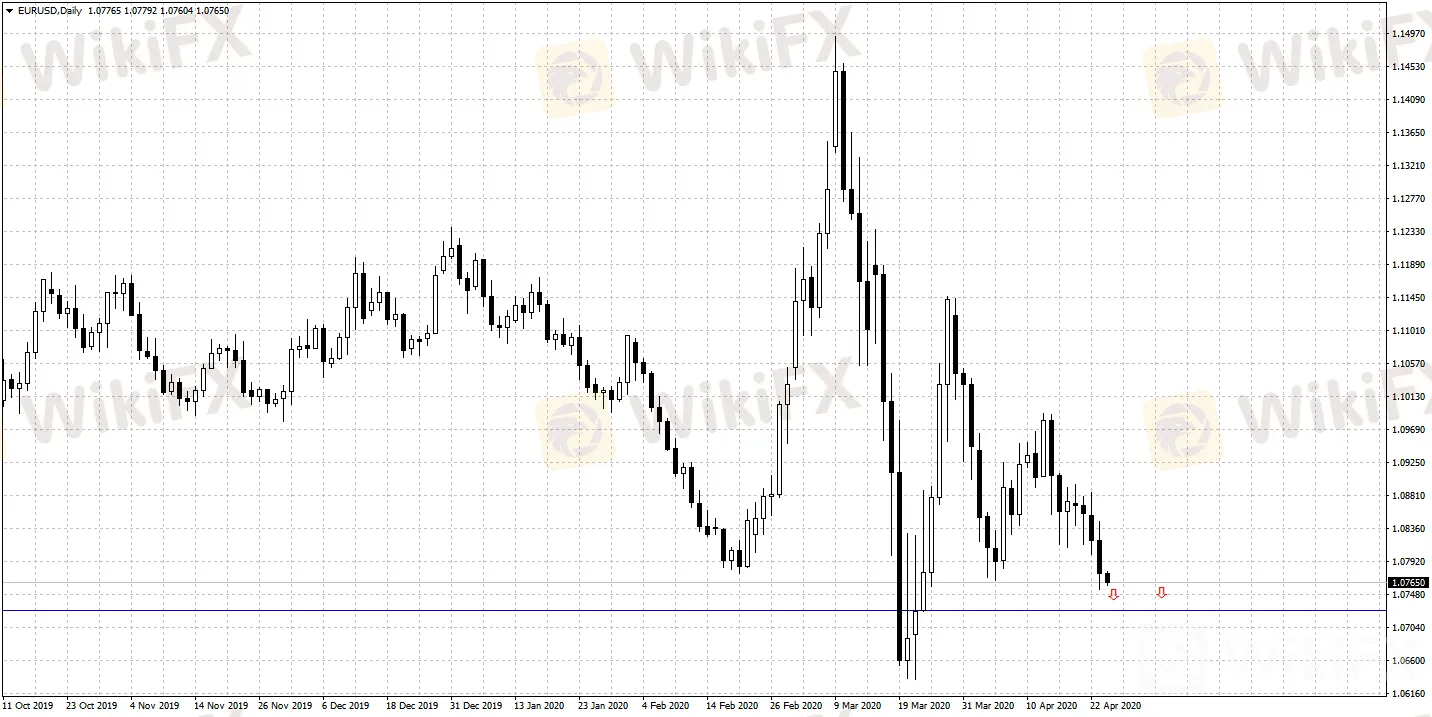

EUR/USD daily pivot points: 1.0785-1.0801

S1 1.0740 R1 1.0831

S2 1.0702 R2 1.0884

अस्वीकरण:

इस लेख में विचार केवल लेखक के व्यक्तिगत विचारों का प्रतिनिधित्व करते हैं और इस मंच के लिए निवेश सलाह का गठन नहीं करते हैं। यह प्लेटफ़ॉर्म लेख जानकारी की सटीकता, पूर्णता और समयबद्धता की गारंटी नहीं देता है, न ही यह लेख जानकारी के उपयोग या निर्भरता के कारण होने वाले किसी भी नुकसान के लिए उत्तरदायी है।

WikiFX ब्रोकर

WikiFX ब्रोकर

रेट की गणना करना