简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Doctor Trapped by 520% Profit Promise, Loses RM8.7 Million

Abstract:A 53-year-old doctor in Malaysia has lost her entire life savings of RM8.7 million after falling prey to a sophisticated online investment scam that promised massive returns from stock trading.

A 53-year-old doctor in Malaysia has lost her entire life savings of RM8.7 million after falling prey to a sophisticated online investment scam that promised massive returns from stock trading.

According to Johor Bahru Selatan deputy police chief Azrul Hisham Shaffei, the woman came across a trading advertisement on social media in April. Intrigued by claims of high profits, she began communicating with an individual featured in the ad to learn more about the investment opportunity.

The scammers presented her with a tempting offer of up to 520% on her capital. Enticed by the promise of fast and substantial profits, she proceeded to transfer large sums of money to multiple bank accounts over three months, from May to July. In total, she deposited RM8.7 million, trusting that her investment would yield high returns.

However, the promised profits never materialised. Instead, the victim was told that her investment had only generated RM6,033. To access her funds, she was instructed to pay an additional RM500,000 as a “deposit”. The scammers threatened to freeze her account if she refused to comply, which ultimately led her to suspect she had been defrauded.

She reported the case to local authorities on Tuesday. The investigation is now underway under Section 420 of the Malaysian Penal Code, which covers offences related to cheating.

This case underscores the tactics commonly used by cybercriminals: exploiting victims trust with offers that appear both legitimate and lucrative. Social media has become a key platform for scammers to reach potential targets, often with well-crafted advertisements and convincing profiles.

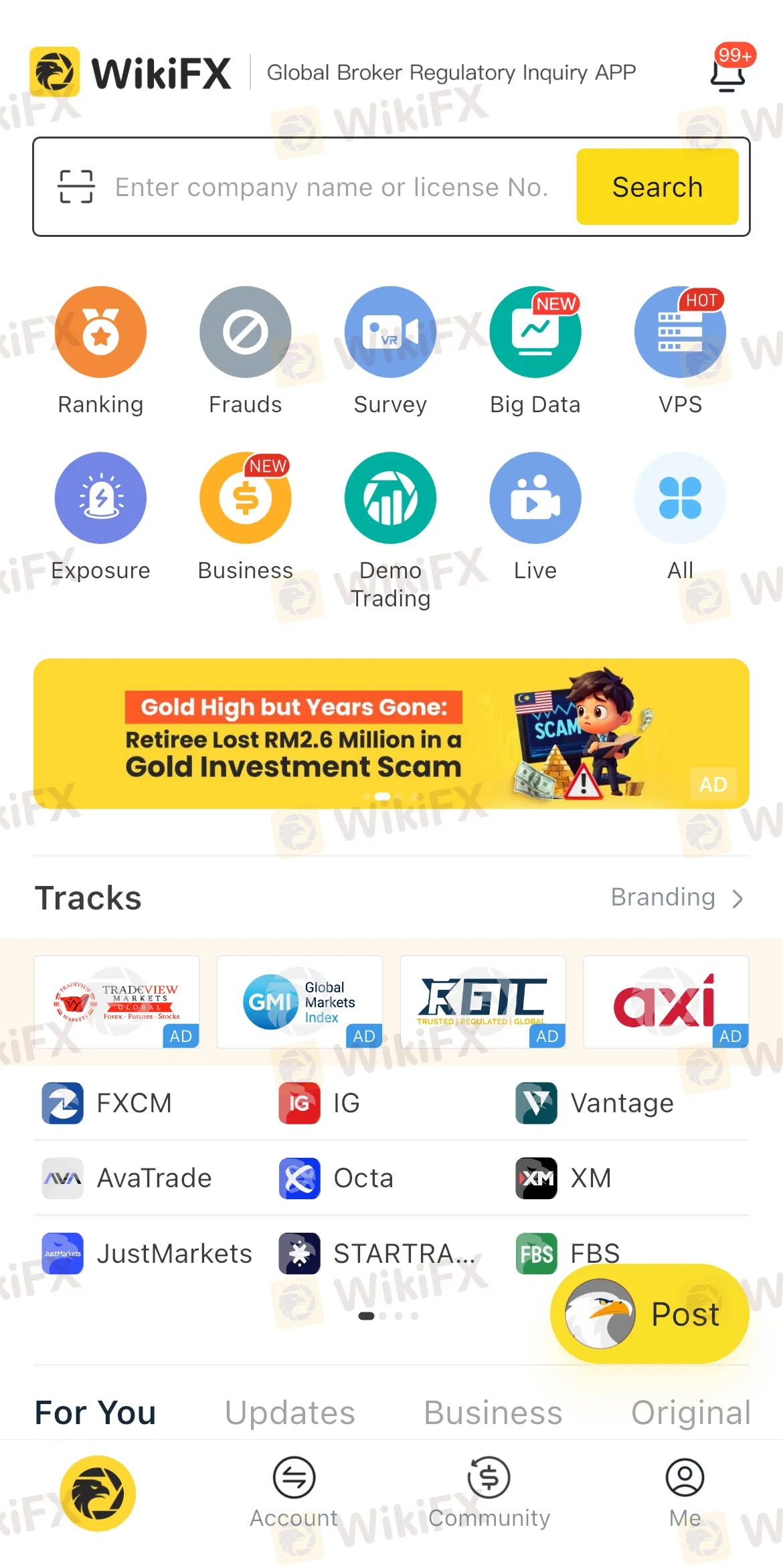

In the wake of such incidents, experts stress the importance of verifying the legitimacy of any investment platform before transferring funds. Tools like WikiFX are proving valuable in this regard. WikiFX offers detailed background checks on brokers, including their regulatory status, customer feedback, and overall safety scores. By providing insights and risk alerts, WikiFX enables users to make informed choices and avoid engaging with unlicensed or fraudulent platforms. With scams growing increasingly sophisticated, conducting proper due diligence can mean the difference between financial security and devastating loss.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

PaxForex Review 2025: Is It Safe or a Scam?

PaxForex Review 2025: Discover if PaxForex is a safe broker or a high-risk option. Get insights on regulation, trading instruments, fees, and leverage.

5 Cons of DB Investing Broker You Must Know

It's always advisable to read online review articles about forex brokers you are thinking to Invest your money with. The forex market has become increasingly unsafe due to the rise of fraudulent brokers. Review articles help you spot scam brokers and protect your money. Read this important article about DB Investing to stay fraud alert.

iForex - Where Withdrawal Denials, High Spread & Scams Spoil Your Forex Trading Mood

Are high spreads charged by iForex disallowing you to make profits? Do you feel that you will never be able to withdraw from iForex? It's nothing new! Read this exposure story where we have highlighted complaints from several investors.

Forex Hedging Strategies - Calming You Amid Market Chaos

Finding it hard to deal with the forex market volatility? Do those ups and downs in currency pair prices make you more nervous or worried? You need the right forex hedging strategies. As a concept, forex hedging is about strategically opening additional positions to stay immune against adverse forex price movements. It’s about offsetting or balancing your current positions by buying or selling financial instruments. As a trader, your risk exposure is reduced, hence limiting your potential losses.

WikiFX Broker

Latest News

Forex Hedging Strategies - Calming You Amid Market Chaos

Key Events This Week: ISM, Trade Balance And More Earnings

What Is Forex Currency Trading? Explained Simply

A Beginner’s Guide to Trading Forex During News Releases

Ultima Markets enters the UK and gains the FCA license

LSEG Announces £1 Billion Share Buyback Program

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

Scam Alert: Cloned Broker Scams on the Rise

TradersWay Broker Review 2025: Unregulated Status and Global Warnings You Shouldn’t Ignore

Currency Calculator