简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Durable Goods Orders (Ex-Transports) Beat Expectations In June

Abstract:After surging higher in May, on the back of huge Boeing aircraft orders, US durable goods orders wer

After surging higher in May, on the back of huge Boeing aircraft orders, US durable goods orders were expected to tumble back to earth in preliminary June data... and they did.

Durable Goods Orders plunged 9.3% MoM (slightly better than the -10.7% MoM expected) - the biggest drop since the COVID lockdowns. But as the chart below shows, it is a wildly noisy time series, almost entirely due to the lumpiness of aircraft orders...

Source: Bloomberg

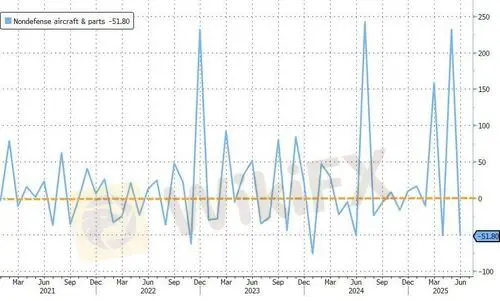

Thanks to a swing from a 230% MoM rise to a 50% MoM decline in non-defense aircraft orders...

Source: Bloomberg

Excluding the noise of Boeing orders, the data was actually solid with a 0.25% MoM increase (better than the 0.1% rise expected) in durable goods orders (ex-Transports),pushing YoY orders uo 2.23%

Source: Bloomberg

Adding to the confusion, the value of core capital goods orders, a proxy for investment in equipment excluding aircraft and military hardware, decreased 0.7% last month after an upwardly revised 2% gain in May

Capital goods shipments rose 0.4%, excluding defense and commercial aircraft, better than the +0.2% expected, adding to Q2 GDP growth hopes.

A very mixed picture from a generally considered 'secondary' economic indicator... and this the market reaction is muted to say the least.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Asia-Pacific stocks fall as investors weigh recent trade developments

Is Your Forex Strategy Failing? Here’s When to Change

FSMA Warns That Some Firms Operate as Pyramid Schemes

Apex Trader Funding is an Unregulated Firm | You Must Know the Risks

LVMH shares jump 2.5% after reporting better-than-feared earnings, Texas factory plans

Why Octa Is the Ideal Broker for MetaTrader 4 & 5 Users

Stop Level Forex: How Does it Help Traders Prevail When Losses Mount?

5 things to know before the Thursday open: Meme stock revival, Trump's Fed visit, Uber's gender feature

CNBC's Inside India newsletter: Leaving, but not letting go — India's wealthy move abroad, but stay invested

Moncler raises prices on tariffs, may postpone store openings if downturn worsens

Currency Calculator