简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

OspreyFX Trading Demo and Spread Comparison by Account

Abstract:Discover OspreyFX trading account options, demo access, spreads, commissions, and leverage in this detailed breakdown of costs and types.

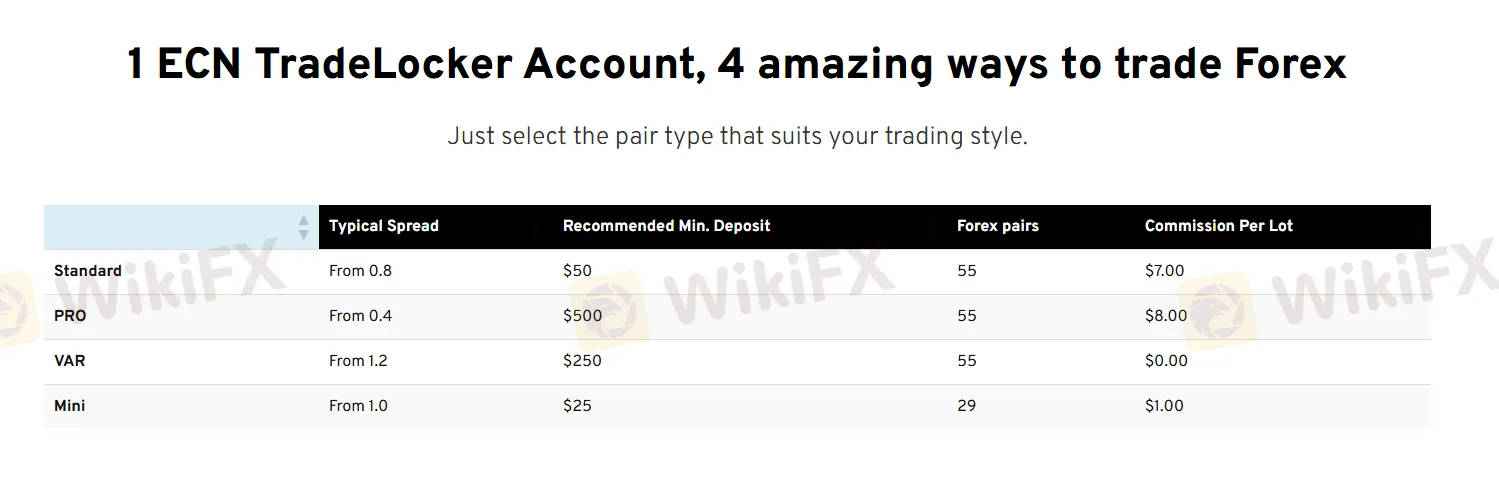

What Are the Account Types and Spreads at OspreyFX?

OspreyFX provides simple but powerful account types suitable for beginners to aggressive traders. With a minimum deposit starting from $10 and leverage up to 1:500, the platform offers a demo account for training and real accounts with raw ECN spreads starting at 0.1 pips.

What Account Options and Trading Conditions Does OspreyFX Offer?

| Account Type | Minimum Deposit | Spreads | Commission | Leverage | Execution Model |

| Standard ECN | $10 | From 0.1 pips | $7 per lot (round) | Up to 1:500 | ECN/STP |

| Demo Account | $0 | Simulated | $0 | Variable | Simulated |

OspreyFX does not offer tiered accounts; all users access the same ECN environment. Commissions apply per lot, and floating spreads vary by asset.

FAQs about OspreyFX Account Types & Fees

Q1: Does OspreyFX offer a demo account?

A: Yes, a fully functional demo account is available with real market simulation.

Q2: Are there any hidden fees?

A: Commissions and spreads are clearly listed, with no deposit fees. Some withdrawal types incur charges.

Q3: Whats the typical spread on EUR/USD?

A: It often starts from 0.1 pips, but can vary depending on liquidity and market volatility.

Q4: Can I change leverage?

A: Yes, traders can request leverage changes through support.

Q5: Are there different account types for VIPs?

A: No. OspreyFX provides a single ECN account model for all real traders.

Q6: Is Islamic Account available?

A: Theres no mention of swap-free Islamic accounts on their website.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

MFSA Warns of Digital Market Mining Scam: Alchemy Markets Clone

Alchemy Markets Launches Seamless TradingView Integration

Drawdown in Forex Trading

WikiFX Report: Five Forex Brokers with No Spread

Two Candle Patterns

EC Markets Expands with New Office in Mauritius

What WikiFX Found When It Looked Into CORSA FUTURES

European stocks set to rally at the open as U.S.-Japan trade deal boosts global market sentiment

Just be yourself' is bad advice, says expert—here's what successful people do instead

Opendoor leads meme stock redux on Wall Street with shares tripling in one week

Currency Calculator