简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What WikiFX Found When It Looked Into BingX

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about BingX and its licenses.

In the world of online trading, the absence of proper regulation is a significant red flag. BingX is a broker that currently holds no valid regulatory license, and user complaints about withdrawal issues add to the concern. Traders should not overlook these warning signs.

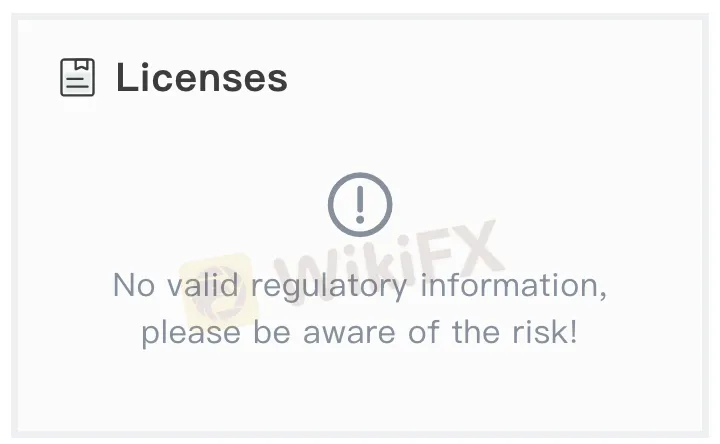

According to WikiFX, BingX has not been verified to hold any valid license from recognized regulatory authorities. The absence of regulatory oversight means that the broker is not subject to any formal standards related to customer protection, financial transparency, or operational conduct. This can create serious risks for traders, especially those relying on platforms to manage or hold client funds.

Being regulated typically requires brokers to follow strict rules, including maintaining minimum capital requirements, segregating client funds, and submitting to audits. Without a license, there is no independent body ensuring that these standards are met by BingX.

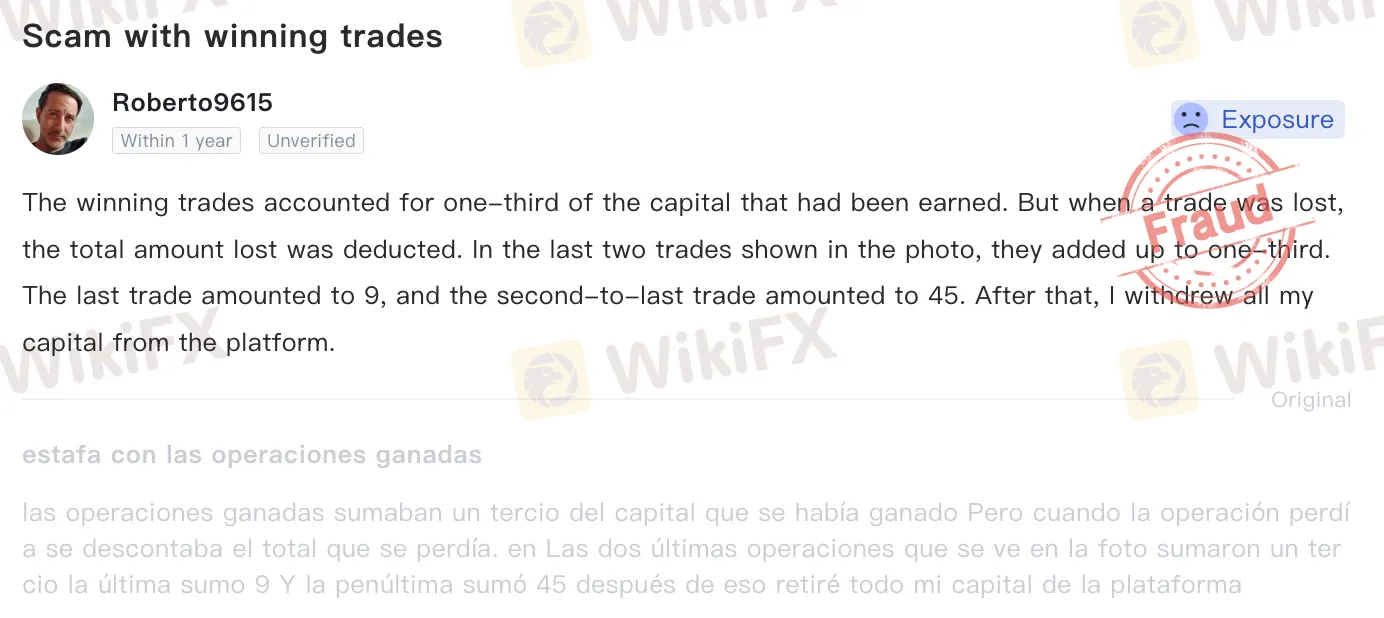

In addition to the regulatory gap, BingX has also received a number of complaints from users. A recurring issue raised by traders is that withdrawal requests go unprocessed, leaving users without access to their funds. These unresolved issues can create trust concerns and may indicate weaknesses in customer support or internal controls.

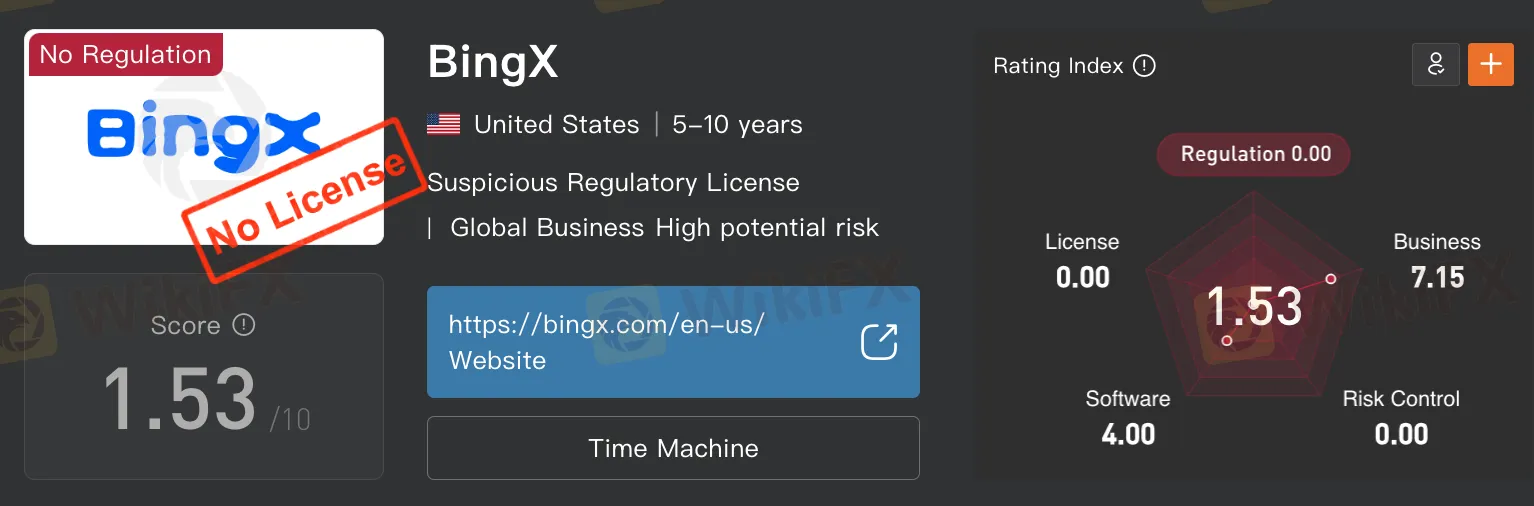

WikiFX, a global broker regulatory query platform, has given BingX a WikiScore of 1.53 out of 10. This score reflects a low rating based on multiple factors, including licensing status, operational transparency, risk management, platform performance, and user feedback. The low score may suggest that traders proceed with caution and consider verifying all details independently before opening an account.

BingX presents several important considerations for traders. The lack of regulation and the existence of unresolved complaints make it essential for potential users to thoroughly research and evaluate the platform. In the absence of formal oversight, traders may have limited recourse in the event of disputes or financial loss. Conducting due diligence and prioritizing safety should always be part of any decision-making process when selecting a trading broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

BlackBull: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about BlackBull and its licenses.

Dark Side of AETOS: They Don’t Want You to Know

AETOS is an Australia-based broker. All over the internet, you will find positive reviews about this broker, but no one is talking about the risks involved with AETOS. However, we have exposed the hidden risks associated with AETOS

Contemplating Investments in Quotex? Abandon Your Plan Before You Lose All Your Funds

Have you received calls from Quotex executives claiming to offer you returns of over 50% per month? Do you face both deposit and withdrawal issues at this company? Or have you faced a complete scam trading with this forex broker? You're not alone. Here is the exposure story.

15 Brokers FCA Says "Are Operating Illegally" Beware!

If a reputable regulator issues a warning about unlicensed brokers, it's important to take it seriously — whether you're a trader or an investor. Here is a list you can check out- be cautious and avoid getting involved with these scam brokers.

WikiFX Broker

Latest News

Lead Prices Remain in the Doldrums Despite Seasonal Expectations

Myanmar Tin Ore Shipments from Wa Region Set to Resume

Major U.S. Banks Plan Stablecoin Launch Amid Crypto Regulations

SHFE Tin Prices Stabilise in the Night Session After Initial Decline

Treasury yields rise as Trump denies plans to fire Fed Chair Powell

Forex Trading Simulator vs Demo Account: Key Differences

Different Forex Market Regulators But One Common Goal - Investor Safety

Do You Really Understand Your Trading Costs?

5 Reasons Why Some Traders Choose XChief

Harsh Truths About ATC Brokers Every Trader Must Know

Currency Calculator