简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Tradovate Trading Leverage and Commissions – Account Pricing Explained

Abstract:Get clarity on Tradovate trading leverage, commission structures, and account pricing. Compare Free, Monthly, and Lifetime plans for active traders.

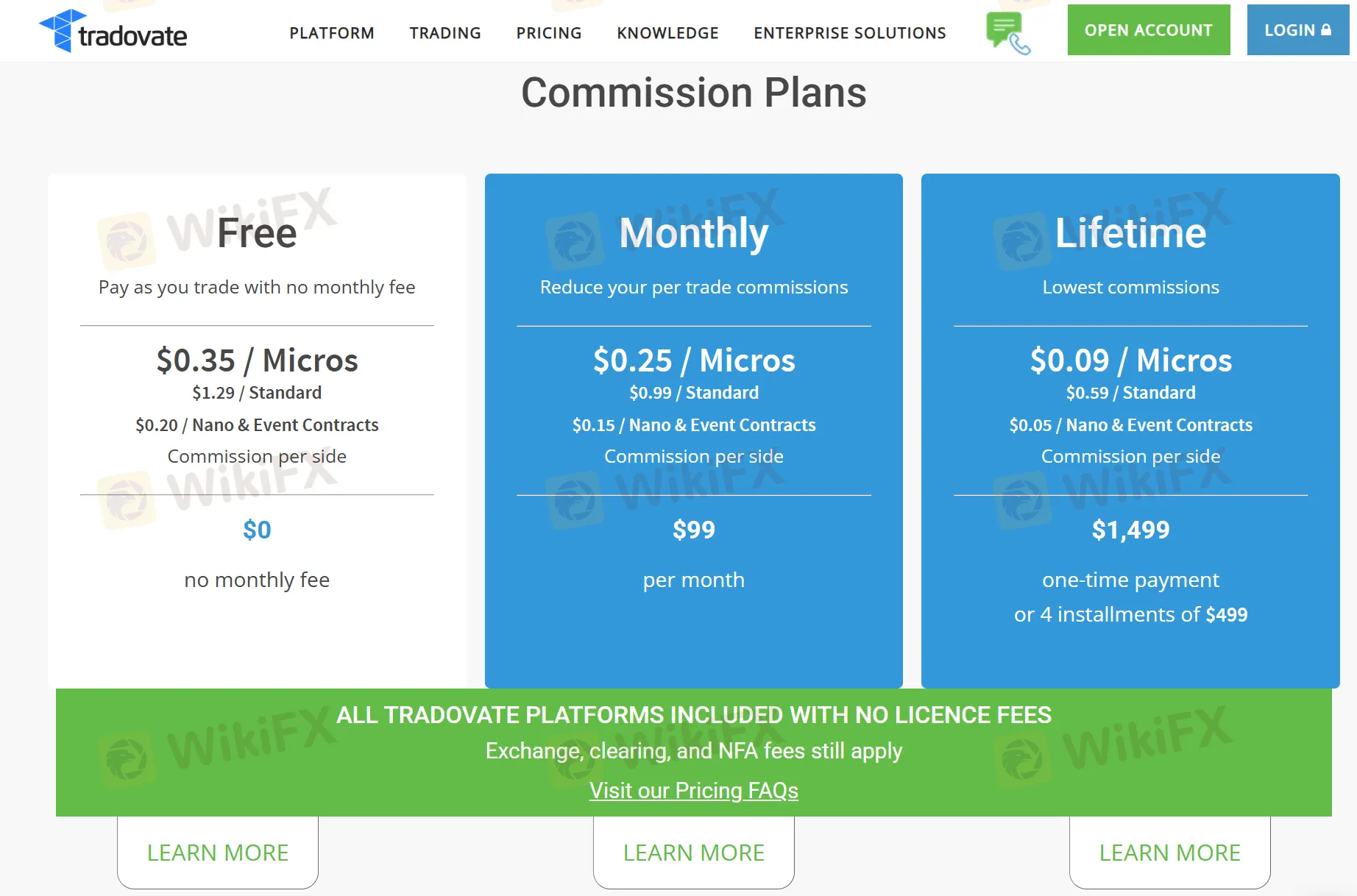

What Kind of Pricing Models Does Tradovate Use?

Tradovates pricing structure is plan-based, not account-tier-based. Traders choose from three commission models—Free, Monthly Subscription, and Lifetime License—all of which grant full access to the platform's features. There are no traditional account types like “Standard” or “ECN,” nor are there minimum deposits.

What Pricing Tiers and Leverage Are Available?

| Plan Type | Monthly Fee | Micros Per Side | Full Contracts | Crypto/Event | Leverage |

| Free | $0 | $0.39 | $1.29 | $0.20 | Exchange-determined |

| Monthly Plan | $99 | $0.29 | $0.99 | $0.15 | Exchange-determined |

| Lifetime | $1,499 once or 4x$499 | $0.09 | $0.59 | $0.05 | Exchange-determined |

Leverage is defined by the exchanges (e.g., CME), typically ranging from 1:20 to 1:50 depending on the instrument.

FAQs about Tradovate Account Type & Fees

Q1: Is there a minimum deposit to open an account?

No. Tradovate does not require a minimum deposit for platform access.

Q2: Which plan is best for high-volume traders?

The Lifetime plan offers the lowest commissions and is best for frequent traders.

Q3: Do commissions vary by asset type?

Yes. Micro futures, full futures, and crypto/event contracts each have different per-side rates.

Q4: Is there an inactivity fee?

Yes. If no live trades occur during a calendar month, a $35 admin fee may be charged.

Q5: Are there hidden costs beyond commissions?

Only exchange, clearing, and regulatory fees (e.g., NFA fees) apply additionally.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

MFSA Warns of Digital Market Mining Scam: Alchemy Markets Clone

Alchemy Markets Launches Seamless TradingView Integration

Drawdown in Forex Trading

WikiFX Report: Five Forex Brokers with No Spread

Two Candle Patterns

EC Markets Expands with New Office in Mauritius

What WikiFX Found When It Looked Into CORSA FUTURES

European stocks set to rally at the open as U.S.-Japan trade deal boosts global market sentiment

Just be yourself' is bad advice, says expert—here's what successful people do instead

Opendoor leads meme stock redux on Wall Street with shares tripling in one week

Currency Calculator