简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | BDSwiss: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of BDSwiss, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of BDSwiss, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2012, BDSwiss operates as an online brokerage offering the trading of exchange-traded CFDs, with spreads as low as 0 pips.

The company provides a diverse range of over 250 tradable assets, including currency pairs, commodities, stocks, global indices, and cryptocurrencies.

Additionally, BDSwiss offers an Introducing Broker (IB) programme and an affiliate programme, which allow individuals and businesses to earn multi-tiered commissions by referring new clients to the company.

It is important to note that, at present, BDSwiss does not offer its services in Algeria, Bahrain, Cyprus, the Democratic Peoples Republic of Korea, the Democratic Republic of the Congo, Egypt, Eritrea, Iran, Iraq, Israel, Japan, Jordan, Kuwait, Lebanon, Libya, Mauritius, Morocco, Myanmar, Oman, Palestine, Qatar, Saudi Arabia, Seychelles, Somalia, Sudan, Syria, Tunisia, the United Arab Emirates, the United Kingdom, the United States (including U.S. reportable persons), Yemen, and the European Union.

Types of Accounts:

BDSwiss offers four account options: the Cent Account, the Classic Account, the VIP Account and the Zero-Spread Account.

Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

BDSwiss offers a range of payment options, including bank transfers, Visa, Mastercard, Skrill, Neteller, and more.

While BDSwiss asserts a policy of not imposing any commission or fees for deposits and withdrawals, it is important to note that any fees levied by third-party providers shall be the responsibility of the trading client.

The company asserts a commitment to processing all withdrawal requests within 24 hours on business days.

The timeframe for funds to reflect in the account depends on the selected withdrawal method. Details for each deposit and withdrawal option can be found in the images below:

Trading Platforms:

BDSwiss offers the MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web, renowned for its technological sophistication, which provides access to a depth of market and various advanced solutions. It offers features such as buy and sell flexibility with six types of pending orders, 38 technical indicators, 44 analytical objects, and 21 timeframes, providing a customizable platform with numerous online tools for integration. Quick order execution, an economic calendar for tracking global macroeconomic news, one-click trading, mobile trading capabilities, and an intuitive market search and grouping functionality contribute to the platform's comprehensive and user-friendly trading experience.

Research and Education:

BDSwiss offers a variety of educational resources to support traders at different levels, including beginners, intermediate, and advanced. These resources are available in the form of both texts and videos.

Customer Service:

BDSwiss offers customer support in several foreign languages, including English, Spanish, Thai, Turkish, Arabic, and others, via its live chat function and email (support@km.bdswiss.com).

Conclusion:

To summarize, here's WikiFX's final verdict:

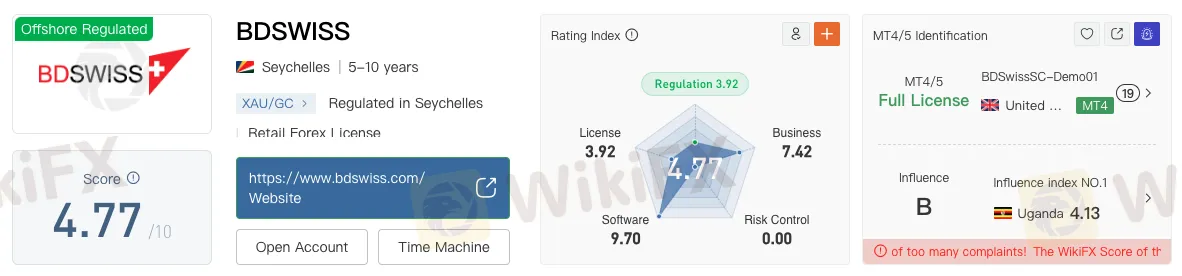

WikiFX, a global forex broker regulatory platform, has assigned BDSwiss a WikiScore of 4.77 out of 10.

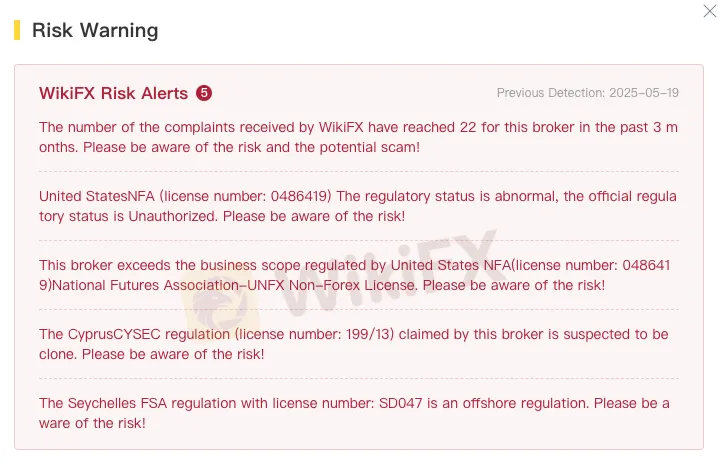

Upon reviewing BDSwisss licensing credentials, WikiFX found that only one of the three licences the broker claims to hold is valid and authentic.

BDSwiss has also received several complaints from users worldwide, casting doubt on its trustworthiness.

Therefore, WikiFX advises users to choose a broker with a higher WikiScore for greater credibility and security.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

2025 LiteFinance Latest Review

As one of the veteran platforms in the forex market, LiteFinance has attracted many traders with its stable trading environment and wide range of products. But who is it best suited for? This article offers a comprehensive evaluation.

RM720,800 Lost to an Online Investment Scam Advertised on Facebook

A 58-year-old trader lost RM720,800 after falling victim to an online investment scam promoted through a Facebook advertisement. The scam promised big profits and convinced the man to transfer large sums of money to several bank accounts over a short period.

Spreadex Fined £2M for Repeated Gambling Compliance Failures

UK Gambling Commission fines Spreadex £2M for anti-money laundering and social responsibility breaches, marking its second major penalty in three years.

LiteFinance Launches Partner App to Boost Affiliate Earnings

LiteFinance introduces a mobile app for affiliates, offering real-time tracking, multilingual support, and a $1M anniversary challenge to enhance earnings.

WikiFX Broker

Latest News

The RM300 Mistake That Cost Her RM19,050

HDFC BANK: Is This Indian Bank Worth Your Money?

FIBO Group Review 2025: Is This Forex Broker a Scam or Legit?

The Forces That Move Markets & How to Read Them

Trade Nation 2025 Review: Spreads, Platforms, FCA and ASIC Licenses

CNMV Warns of Clone Sites Targeting EU Investors

CONSOB Blocks Multiple Domains Linked to Five Unlicensed Platforms

Could IBKR Be the Next Big Trading Opportunity?

LiteFinance Launches Partner App to Boost Affiliate Earnings

Bitget Brings Starlink Internet to Remote Siargao Communities

Currency Calculator