简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Southeast Asia’s Booming Investment Scams | How Smart Traders Stay Safe

Abstract:The stories are all too familiar: “A slick website, aggressive marketing on social media, promises of guaranteed returns, and then radio silence when it’s time to withdraw.”

In recent years, Southeast Asia has emerged as one of the worlds fastest-growing hubs for retail forex trading. As internet penetration, digital literacy, and mobile-first banking continue to expand across the region, many are turning to online trading and investment as a path toward financial independence.

But alongside this boom, a darker trend has surfaced: the rapid rise of unregulated and fraudulent forex brokers exploiting the trust and ambitions of new traders.

According to regional watchdogs and financial literacy organizations, scam-related losses in online trading have surged. Many of these victims fall prey to platforms that appear legitimate, but are in fact operating without licenses, using fake regulatory claims, or vanishing entirely once deposits are made.

The stories are all too familiar: “A slick website, aggressive marketing on social media, promises of guaranteed returns, and then radio silence when its time to withdraw.”

In regions where regulatory oversight varies significantly, traders are increasingly seeking tools to verify broker legitimacy before committing funds. One platform leading the charge in this mission is WikiFX, a global broker verification and regulatory data service that has become particularly influential among traders in Southeast Asia.

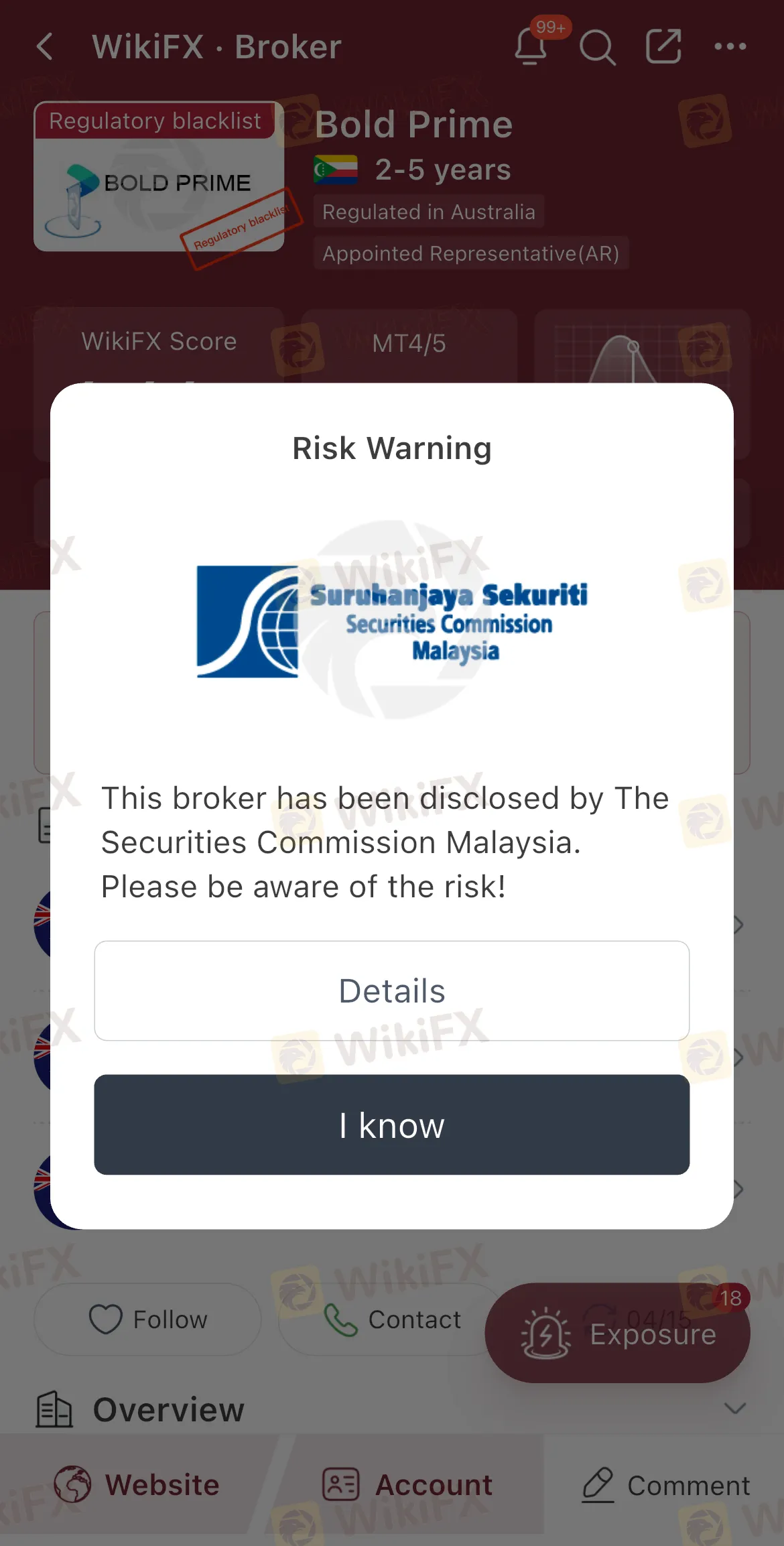

WikiFX houses regulatory data from over global financial authorities, including the FCA (UK), ASIC (Australia), CySEC (Cyprus), MAS(Singapore), and others. The platform currently monitors more than 50,000 brokers worldwide, providing transparency through license verification, user reviews, regulatory blacklists, and office location validation.

At the core of WikiFXs value is its free mobile application, available on both iOS and Android. The app is designed for ease of use for everyone.

Key features include:

- Regulatory Status Lookup: Instantly check if a broker is licensed and by whom.

- Broker Scorecard: A comprehensive trust rating based on compliance, transparency, and operational history.

- Real Trader Reviews: Hear directly from other users in/beyond your region.

- Scam Alerts: Stay informed of brokers flagged for fraud or misconduct.

- Geolocation Verification: See whether a brokers claimed office location actually exists.

While many still dream of financial freedom through forex and other forms of online trading, theyre no longer willing to gamble with unverified platforms. Instead, they are arming themselves with tools and data, determined to make smarter, safer choices.

As forex trading continues to expand in Southeast Asia, the presence of unregulated brokers remains a serious threat. But the growing adoption of verification platforms like WikiFX marks a turning point in the industry by giving everyday traders the means to protect themselves and elevate the standards of the trading ecosystem.

Whether youre trading part-time or aiming to go full-time, one thing is clear:

In an industry where misinformation can cost you everything, the smart move is to verify before you trade. Thats what makes WikiFX essential.

The WikiFX app is free to download on iOS and Android. To learn more, visit www.wikifx.com.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Nonfarm Data Lifts Market Sentiment, U.S. Stocks Rebound Strongly

U.S. nonfarm payrolls for May slightly exceeded expectations, stabilizing investor sentiment and easing fears of a hard landing. This upbeat data sent U.S. equities broadly higher, led by tech stocks, with the Dow and S&P 500 posting significant gains. However, behind the optimism lies a fresh round of market debate over the Federal Reserve’s rate path, with uncertainty around inflation and interest rates remaining a key risk ahead.

OctaFX Flagged by Malaysian Authorities

OctaFX has been officially listed on warning lists by both Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC). These alerts raise serious concerns about the broker’s status and whether it is legally allowed to operate in Malaysia.

Why Your Worst Enemy in Trading Might Be You

Be Honest With Yourself: Are You Slowly Destroying Your Trading Account?

TradingPRO: A Closer Look at Its Licences

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about TradingPRO and its licenses.

WikiFX Broker

Latest News

SkyLine Guide 2025 Malaysia: 100 Esteemed Judges Successfully Assembled

Vantage Markets Review 2025: Trusted Forex and CFD Trading Since 2009

Why STARTRADER Is Popular Among Traders?

A Guide to Intraday Forex Trading You Can't Miss Out

CONSOB Blocks Access to 13 Unauthorized Investment Websites

TradingPRO: A Closer Look at Its Licences

The world could be facing another ‘China shock,’ but it comes with a silver-lining

New SEBI Regulations on Intraday Trading

Everything You need to know about Barath Trade

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

Currency Calculator