简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

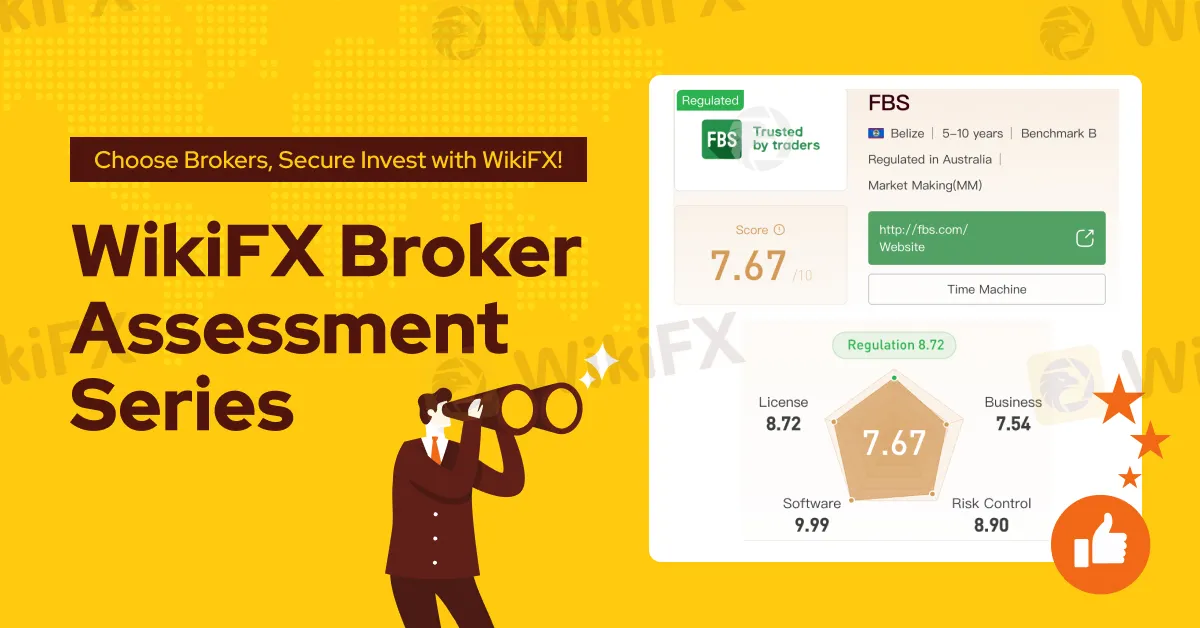

The Most Comprehensive Review of FBS in 2025

Abstract:This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

Basic Introduction

FBS is an internationally recognized broker with a significant presence in Asia, offering a variety of trading instruments such as forex, stocks, indices, energy, and metals. With over 90 international awards, FBS serves 27 million customers in 150 countries, earning a stellar reputation globally.

The company offers flexible trading conditions, floating spreads starting from 0.7 pips, commission-free trading, and fast execution speeds from 0.01 seconds. FBS ensures customer safety with negative balance protection and provides a user-friendly experience on familiar trading platforms.

Features

FBS offers negative balance protection, ensuring users are not exposed to the risk of losing more than their account balance due to market fluctuations. The platform also provides various trading tools to meet the needs of different traders, whether they are beginners or experienced investors. To further enhance the user experience, FBS offers 24/7 customer support, answering queries and providing assistance as needed.

Fees

FBS offers flexible trading conditions for traders, allowing up to 500 open positions, including 200 pending orders. The leverage is adaptable to suit traders with different risk preferences. The minimum deposit is just $5, making it accessible for beginners. The order volume ranges from small to large positions, accommodating various trade sizes.

Trading Platforms

FBS provides multiple platforms, including MetaTrader 4, MetaTrader 5, and the FBS App.

The FBS App offers a convenient tool for investors to analyze market trends using easy-to-use charts, manage orders, and access the market anytime, anywhere. Investors can start trading quickly with a simple registration process, streamlined verification, and easy deposit options. With just one click, investors can view account equity, margin, available margin, and floating P&L to assess trading opportunities.

No matter where they are, investors can access charts and customize them according to their needs. By utilizing more than 90 indicators, they can identify price trends and make informed trading decisions.

Product Range

FBS offers a range of core products, including forex and stocks, to meet the primary investment needs of most individual investors. These products provide flexible investment options suitable for different types of traders.

To learn more about the reliability of a particular broker, you can visit our website (https://www.WikiFX.com/en) or download the WikiFX app, which helps you find the most trustworthy brokers, ensuring safer and more reliable trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Prices Fall Instead of Rising, Hitting a Two-Week Low

Despite geopolitical tensions, gold prices have dropped sharply, reaching a two-week low. Markets refocus on Fed policy and broader macro trends.

Nigeria to Launch Sweeping Cybersecurity Reforms Amid Rising Digital Threats

With cyber threats escalating and economic losses exceeding ₦250 billion annually, Nigeria is launching comprehensive reforms to safeguard its digital future and build a more resilient cybersecurity infrastructure.

Reviewing CFreserve - Regulation Status, Operation Period & More

Has CFreserve deceived you financially? Did you face problems regarding forex investment withdrawals with this broker? You’re not alone! Read this exposure story to know how it's duping investors.

Trading 212 Expands German Footprint with New Berlin Office

Trading 212, a leading Forex trading broker, strengthens its presence in Germany with a new Berlin office. Discover how the platform is shifting focus from CFDs to stockbroking and tax-efficient savings.

WikiFX Broker

Latest News

HYCM Broker Review 2025: A Comprehensive Overview

OneRoyal Expands to Oman, Strengthening Forex Trading in MENA

Govt Imposes Import Curbs on Precious Metal to Stop Liquid Gold Inflow

Reviewing CFreserve - Regulation Status, Operation Period & More

Starlink rival Eutelsat pops 22% as France backs capital raise

The Fed held interest rates steady, but some credit card APRs keep going up. Here's why

Meta, EssilorLuxottica unveil Oakley smart glasses

WikiFX’s Complimentary Protection Services Aim to Safeguard Investors' Legal Rights and Interests

Exness Acquires €75 Million Property in Cyprus for Future Growth

TradeHall vs. HYCM: Which Broker Should You Choose?

Currency Calculator