简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Exposing Fraud: Pakistan Trader's Case with NebulaForex

Abstract:In the world of forex trading, the promise of high returns can be tempting, especially when marketed by seemingly credible individuals. However, the story of Masooma, a 33-year-old trader from Pakistan, serves as a stark reminder of the potential dangers lurking in the online trading space, particularly with brokers like NebulaForex.

The Initial Encounter

Masooma's ordeal began when she was approached on Telegram by someone claiming to be Jessica Inskips, promoting an enticing cryptocurrency trading opportunity. Despite her initial hesitance, the allure of high returns convinced her to invest in what she believed was a legitimate opportunity.

Investment Breakdown:

- Initial Deposit: $10

- Follow-Up Deposit: $50

- Additional Deposit: $50 (requested to increase her investment)

Masooma's total investment reached $100. Shortly after her second deposit, she was informed that she had generated a profit of $85. This news fueled her hopes of recouping her investment and making a profit. However, when she requested to withdraw her earnings, the broker demanded a “commission fee” of $66.

The Red Flags

Believing that this fee would finally allow her to access her funds, Masooma complied and sent the payment. Unfortunately, this decision marked the beginning of a downward spiral. After paying the fee, her account became unresponsive, and her withdrawal request was ignored.

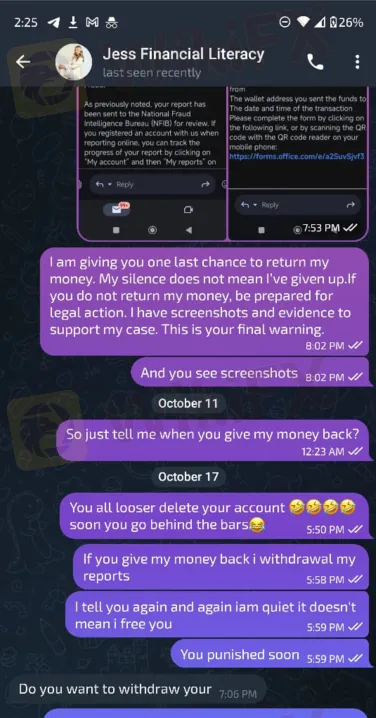

Instead of receiving her funds, Masooma was told she needed to pay an additional $140 to cover fees on her capital before any withdrawals could be processed. Realizing she was likely caught in a scam, she refused to comply, leading to her account being locked.

The Aftermath

Despite her numerous attempts to recover her money and requests for assistance, Masooma has been met with silence. To make matters worse, NebulaForex attempted to lure her into another scam, offering a promise of a $2,000 withdrawal if she deposited an additional $360 into their “other platforms.”

Masooma has meticulously documented all communications, transactions, and evidence related to her experience. Her story is a crucial warning to others in the trading community, highlighting the risks associated with unregulated brokers and scams that often masquerade as legitimate investment opportunities.

Conclusion

NebulaForex‘s actions exemplify the darker side of forex trading, where unscrupulous brokers exploit unsuspecting investors. Masooma’s experience is a reminder to conduct thorough research and exercise caution before investing in any trading platform. If you or someone you know has faced similar issues, sharing your story could help prevent others from falling victim to such schemes. For those seeking assistance, reaching out to organizations like WikiFX can be an essential step in addressing fraudulent practices in the trading industry.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Using Any of These Illegal Forex Trading Apps? Stop Before It Turns into a Crisis

The Reserve Bank of India (RBI) has listed out some illegal forex apps India. Read this article to know some of those apps.

IC Markets Sponsors AEL Limassol, Football Club Until 2027

AEL Limassol has renewed its deal with IC Markets (EU) Ltd, who will stay as the team’s Gold Sponsor until 2027. The sponsorship deal was first announced for the 2025–2026 season, but it has now been officially extended until 2027.

5 Reasons to Stay Away from Core Prime Markets

The Forex market is a very unpredictable, complex, and risky place. There are many brokers that appear genuine but can steal your hard-earned money. So, staying alert is the only way to survive in this dynamic environment. Therefore, in this article, we are sharing 5 warning signs about Core Prime Markets.

Think Before You Trade! Unlicensed Brokers List Inside

The French regulator AMF has issued a warning against five unlicensed brokers. Investors are encouraged to verify the list to protect themselves from fraud.

WikiFX Broker

Latest News

Stablecoins go mainstream: Why banks and credit card firms are issuing their own crypto tokens

The Dollar Keeps Falling: How Should We View Exchange Rate Volatility?

Asia-Pacific markets rise as investors parse a slew of data releases

Asia-Pacific markets mostly rise as investors parse a slew of data releases

WikiFX Gala Night Malaysia Concludes Successfully

Are Trading Courses and Mentors a Fast Track or a Financial Trap?

At 20 years old, Reddit is defending its data and fighting AI with AI

Debt is a growing force' influencing jobseekers' choices, career expert says. Here's how

Gas prices are expected to fall: It's going to be the cheapest summer since 2021,' one expert says

The Economy - And Its Future - In Four Charts

Currency Calculator