简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

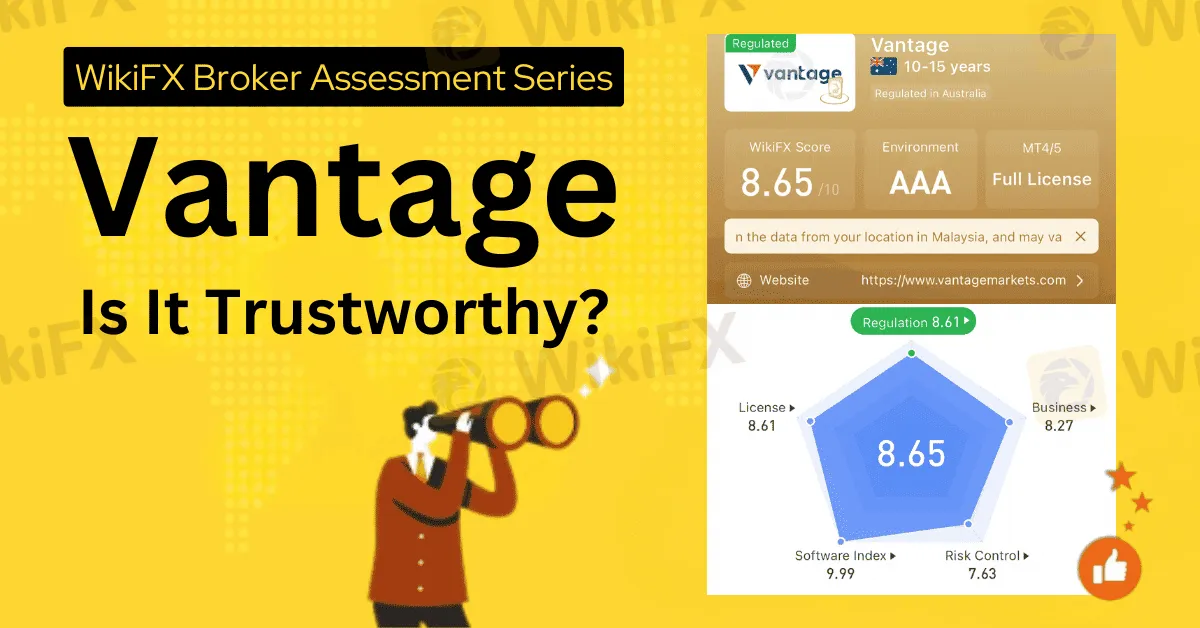

WikiFX Broker Assessment Series | Vantage: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Vantage, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2009, Vantage (also known as Vantage Markets) operates as an online brokerage specializing in the trading of exchange-based CFDs. It distinguishes itself through transparent trading, a leading market platform, fast execution, various technology solutions, low spreads, and minimal starting capital.

Vantage provides a diverse range of tradable assets, including currency pairs, indices, energy, share CFDs, precious metals, soft commodities, ETFs, and bonds.

Additionally, Vantage offers a social trading service, allowing money managers and traders to enhance efficiency, improve profitability, and generate passive income through copy trading.

Vantage also features an Introducing Broker (IB) program, enabling individuals and businesses to earn commissions by referring new clients to the company.

It is important to note that, at present, Vantage does not extend its services to Canada, China, Romania, Singapore, the United States, and jurisdictions on the FATF and EU/UN sanctions lists.

Types of Accounts:

Vantage offers three account options: the Pro ECN Account, the Raw ECN Account, and the Standard STP Account. A swap-free account is also available upon request. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

Vantage offers a range of payment options, including bank transfers, credit/debit cards (Visa, Master, M, AstroPay), e-wallets (Neteller, Skrill, FasaPay), UnionPay, and more.

Clients can deposit funds in the following base currencies: Australian Dollar, US Dollar, Euro, British Pound Sterling, New Zealand Dollar, Singapore Dollar, Japanese Yen, and Canadian Dollar.

While Vantage maintains a policy of not charging commissions or fees for deposits and withdrawals, it's important to note that any fees imposed by third-party providers are the responsibility of the trading client.

Trading Platforms:

Vantage offers a variety of trading platforms:

- Vantage App: This is Vantage's specially curated mobile app, providing a complete and easy-to-use trading and investment platform for both iOS and Android users.

- Vantage ProTrader Platform: Powered by TradingView, the Vantage ProTrader platform gives all clients access to hundreds of popular indicators, over 50 technical drawing tools, and a comprehensive set of tools for in-depth market analysis, including popular trading systems and strategies. When trading on the Vantage ProTrader platform, users can unlock a range of technical indicators and oscillators.

- MT4 Trading Platform (PC, Mobile, Web): This is the most commonly used trading platform in the industry. By using the Vantage MT4 trading platform, traders can take advantage of the global forex market, achieve a steady and continuous increase in trade execution speed, and receive transparent quotes for a variety of trading products.

- MT5 Trading Platform (PC, Mobile, Web): Users trading on Vantage's MT5 platform can activate all EAs and trading signals, as well as use the hedge position feature.

Research and Education:

Vantage offers a variety of educational resources to support traders at different levels, including courses, webinars, eBooks, a terminology list, market analysis, and useful tools such as an economic calendar, VPS, and trading signals.

Customer Service:

Vantage provides 24/7 customer support in multiple languages, including English, French, Thai, Vietnamese, Bahasa Indonesia, Chinese, and many more. Clients can reach Vantage via email at support@vantagemarkets.com or by submitting an inquiry through the broker's contact form. Additionally, trading clients can contact Vantage by phone at +1 (345) 7691640.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned Vantage a WikiScore of 8.65 out of 10.

Upon examining Vantage's licenses, WikiFX found that the broker is regulated by the Australian Securities and Investments Commission (ASIC), the United Kingdom‘s Financial Conduct Authority, the Cayman Islands Monetary Authority, South Africa’s Financial Sector Conduct Authority, and the Vanuatu Financial Services Commission. WikiFX has also validated the legitimacy of these licenses.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex Price Action Strategy: A Must-Read Guide for Serious Traders

Seeking a successful run in forex trading? You need to master the forex price action strategy. Many of your fellow traders are using it to continue earning profits in a volatile market environment. Price action in trading analyzes the performance of a currency pair and provides hints about its potential future direction. If you find that the currency pair price is likely to surge in your price action analysis, taking a long position is advised. If it suggests a price fall, consider taking a short position.

Fortune Wave Solution: SEC Warns of Investment Scam

SEC warns against Fortune Wave Solution Hub OPC’s unlicensed investment schemes. Avoid Ponzi scams; verify licenses before investing in the Philippines.

D. Boral Capital agrees to a fine as a settlement with FINRA

On August 6, 2025, the Financial Industry Regulatory Authority (FINRA) announced that D. Boral Capital agreed to a censure and a $125,000 fine as part of a settlement for failing to maintain the minimum required net capital.

Beware of Fake RS Finance: How to Spot Scams

Beware of Fake RS Finance scams: learn key warning signs, user reviews, and tips to protect your money from fraudulent financial services. Stay safe!

WikiFX Broker

Latest News

Forex Hedging Strategies - Calming You Amid Market Chaos

Key Events This Week: ISM, Trade Balance And More Earnings

What Is Forex Currency Trading? Explained Simply

A Beginner’s Guide to Trading Forex During News Releases

Ultima Markets enters the UK and gains the FCA license

LSEG Announces £1 Billion Share Buyback Program

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

XS.com Broker Partnership Expands Liquidity with Centroid Integration

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

FCA Publishes New Warning List! Check It Now to Stay Safe

Currency Calculator