简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FXDD was acquired by 888 Markets Ltd Acquisition

Abstract:FXDD, a prominent forex broker, has recently sparked widespread concern among its users due to reported difficulties in withdrawals. Many customers have voiced complaints alleging their inability to withdraw funds from the platform. This issue has escalated further with the recent circulation of an email to users, purportedly from FXDD, announcing a change in leadership.

FXDD, a prominent forex broker, has recently sparked widespread concern among its users due to reported difficulties in withdrawals. Many customers have voiced complaints alleging their inability to withdraw funds from the platform. This issue has escalated further with the recent circulation of an email to users, purportedly from FXDD, announcing a change in leadership.

According to the email, FXDD's founder, Emil Assentato, has transferred ownership of FXDD Trading SAC to a new entity, 888 Markets Group (Co. 13397886). This group, described as a consortium of UK-based companies, aims to uphold and continue FXDD's legacy of success. However, scrutiny reveals that 888 Markets Group holds a low rating of 1.49/10 on WikiFX, a platform that rates forex brokers based on user experiences and regulatory status. Importantly, WikiFX notes that 888 Markets Group operates without regulatory licenses, labeling it as a high-risk platform.

Critics and concerned users have questioned the authenticity of FXDD's email, suggesting it may serve as a convenient excuse to delay or deny user withdrawal requests. WikiFX has issued a cautionary statement advising users to remain vigilant and exercise caution when dealing with 888 Markets Group.

The controversy surrounding FXDD highlights the challenges faced by investors in the forex industry, emphasizing the importance of thorough due diligence and regulatory compliance when choosing a brokerage. As developments unfold, stakeholders await further clarification from FXDD regarding the implications of this ownership transfer and its impact on user funds and operations.

Warning! 888 Markets official website is not available. This is a red flag for traders.

About FXDD

FXDD Trading offers a range of market instruments, including forex pairs, metals, energies, indices, cryptocurrencies, and stocks, providing traders with diverse trading opportunities. The platform offers two account types: Standard Account, which provides low spreads with no commissions, and ECN Account, which offers ultra-low spreads but involves small commission costs.

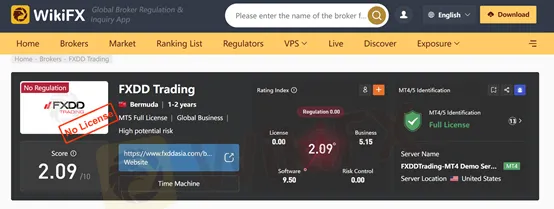

However, one significant drawback of FXDD Trading is the lack of regulatory assurance, which may raise concerns for potential traders. WikiFX has given this broker a low score of 2.09/10.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

OctaFX Flagged by Malaysian Authorities

OctaFX has been officially listed on warning lists by both Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC). These alerts raise serious concerns about the broker’s status and whether it is legally allowed to operate in Malaysia.

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

IronFX Review 2025: Explore the broker’s AAAA WikiFX rating, global regulations, and $500,000 trading prize. Is it trustworthy or a scam? Dive into our transparent analysis!

TradingPRO: A Closer Look at Its Licences

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about TradingPRO and its licenses.

New SEBI Regulations on Intraday Trading

The Securities and Exchange Board of India (SEBI) has implemented revised regulations on Intraday trading, with effect from November 20, 2024. These regulations are meant to lessen risks and prevent speculative trading practices.

WikiFX Broker

Latest News

How much money will you earn by investing in Vantage Broker?

IronFX vs Exness Review 2025: Comprehensive Broker Comparison

Fraudsters Are Targeting Interactive Brokers' Users with Lookalike Emails

Interactive Brokers: Global Office Visits and Licensing Details

Top Tips to Choose the Best Forex Broker in 2025

SEBI Notifies New F&O Rules for Investors - New Derivative Trading Limits & More Amendments

U.S. Jobs Data Released: A Potential Boost for Gold Prices

SkyLine Guide 2025 Malaysia: 100 Esteemed Judges Successfully Assembled

Everything you need to know about ADSS

Vantage Markets Review 2025: Trusted Forex and CFD Trading Since 2009

Currency Calculator