简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dukascopy Bank Launches MetaTrader 5 Platform

Abstract:Dukascopy Bank integrates MetaTrader 5, boosting trading tools and client options. The firm sees profit growth and has launched a new crypto lending program.

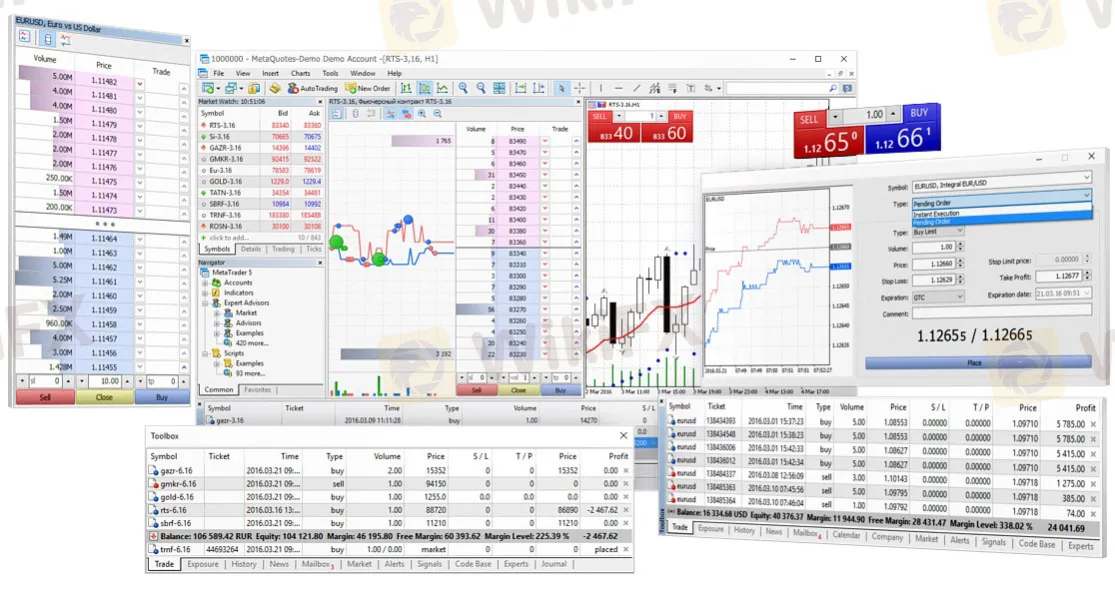

The Swiss city of Geneva - A new trading platform, MetaTrader 5 (MT5), is now available to customers of Dukascopy Bank SA. With the addition of the proprietary JForex 4 and the widely-used MT4, the bank's services for traders in a variety of asset classes have been expanded in this version.

Launching after a successful beta-testing period, Dukascopy is a big step forward for its cryptocurrency, commodities, precious metals, stock, bond, and index trading clients. With its extensive set of analytical tools and technical indicators, MT5's superior features make it a flexible platform for a wide variety of trading techniques.

New and improved technical indicators and time intervals for in-depth research are among the most notable improvements.

Traders may stay updated about financial developments with the inclusion of an economic calendar.

View the market from a Depth of Market (DOM) perspective to learn more about its dynamics.

The release of MetaTrader 5 (MT5) demonstrates Dukascopy's commitment to offering traders cutting-edge trading tools and services. The business made the bold claim that MT5 would provide customers with “unparalleled trading flexibility and analytical capabilities” in addition to enhancing their current platform offerings.

Financial Results

A rise in profitability is highlighted in Dukascopy's most recent financial report. Profit for the bank increased by 39% to CHF 8.5 million, from CHF 6.1 million the year before. An increase in trade volumes and a growing customer base are the reasons for this remarkable rise. From CHF 33.2 million in the same time last year, revenue grew to CHF 39.4 million, an 18% increase.

Annual operating expenditures were CHF 28.9 million, up slightly from CHF 26.6 million the previous year. The main drivers of these expenditures were investments in technology and endeavors to expand internationally. A major source of revenue for the bank, net fee and commission income, increased by 10% despite these higher expenditures.

Crypto Loan Scheme

Dukascopy has introduced a new crypto loan program with platform updates and financial development. Customers may borrow up to half the value of their digital assets in fiat money with this unique solution, letting them leverage their cryptocurrency holdings without giving up control of the original investments.

The program's crypto lending component is housed in Dukascopy's multi-currency bank accounts (MCAs), which users are required to obtain. In the “Investments” area, users may access their digital assets, and then use the “Crypto lending/borrowing” option to send their cryptocurrency to the MCA.

This automated lending platform combines the conventional banking system with the cutting-edge digital asset industry by giving customers the option to borrow US dollars secured by their Bitcoin holdings.

What Lies Ahead

Dukascopy Bank is well-prepared to meet the changing demands of contemporary traders with its full portfolio of products and services, including the integration of MetaTrader 5 and the debut of its crypto financing program. The bank's commitment to technological advancement and global expansion highlights its desire to stay ahead of the competition in the financial services market.

Clients may anticipate more sophisticated trading capabilities and financial solutions aimed at improving their trading experience and financial flexibility as Dukascopy keeps innovating and expanding its services.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Broker Assessment Series | TOPONE Markets: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of TOPONE Markets, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Interactive Brokers Adds Ping An of China ETF to No-Fee Program

Interactive Brokers now includes Ping An of China CSI HK Dividend ETF in its no-transaction-fee program, offering investors low-cost access to Hong Kong’s top dividend-paying stocks.

eToro Broker Review: Something You Need to Know

As a reputable broker that has offered services for decades, eToro has played a significant role in the industry. However, it doesn’t mean it suits every trader. Besides, WikiFX has recently received more than 40 complaints against a broker called eToro. In today’s article, we will offer you a comprehensive review of this broker so that you can have a close overall look at eToro.

Soft Inflation, Firm Yields: Fed Rate Cut Delayed to Year-End

The U.S. bond market initially rallied on cooling inflation but lost steam as Wall Street bet on later rate cuts. Fed policy expectations now lean toward a December easing, dampening gold and boosting equities.

WikiFX Broker

Latest News

Short-Term Pressure Mounts on Gold as Risk Sentiment Improves

How Will the U.S.-China Trade Deal Affect the Dollar and Global Markets?

Radiant DAO Proposes Compensation Plan for Wallet Losses

BitGo Secures MiCA License, Expands Crypto Services Across the EU

Big Changes at Saxo Bank: What Traders and Partners Need to Know

Traders Warned to Stay Alert Amid Growing Exposures for INGOT Brokers

WELTRADE's transformation from Reliable to a Problematic Broker

WikiFX “Elite’s View on the Challenge: Dialogue with Global Investment Leaders” Concludes Successful

Plus500 Review 2025: Trusted CFD Broker with Top Features Unveiled

Plus500 Q1 2025: Strong Growth Amid Trade War, Mehta Acquisition

Currency Calculator