简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A South African Trader Claimed That SWIFT EARNERS Blocks His Withdrawal Request

Abstract:SWIFT EARNERS has emerged as a controversial and highly dubious player. Despite its claims of being a reliable broker with a base in the United States and additional operations in Thailand, the experiences of numerous victims tell a different story. A particularly harrowing account comes from a South African victim who has found himself ensnared in what appears to be a well-orchestrated scam.

SWIFT EARNERS has emerged as a controversial and highly dubious player. Despite its claims of being a reliable broker with a base in the United States and additional operations in Thailand, the experiences of numerous victims tell a different story. A particularly harrowing account comes from a South African victim who has found himself ensnared in what appears to be a well-orchestrated scam.

Case Description

The South African victim, whose identity we are protecting for privacy reasons, recounts their ordeal with SWIFT EARNERS:

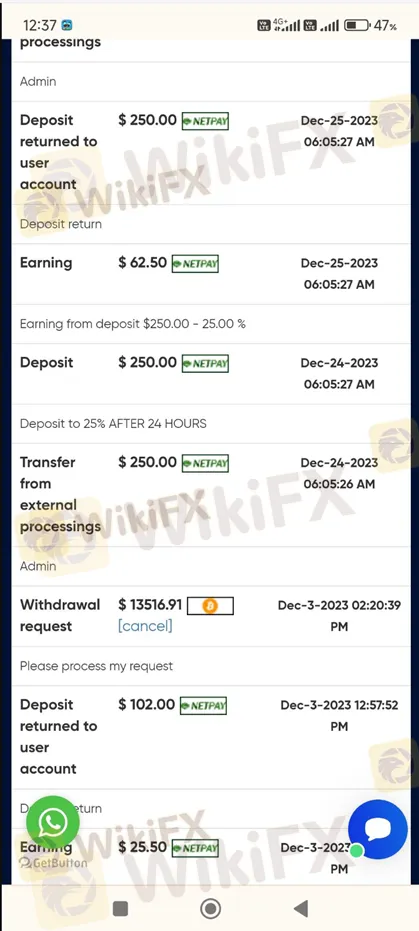

“These people (SWIFT EARNERS) take deposits from people and then dont payout when you want to withdraw. I have spent more than 20 thousand ZAR in withdrawal fees only to be told they have to charge again.”

This statement highlights a common tactic used by fraudulent brokers: imposing exorbitant and repeated withdrawal fees, effectively preventing clients from accessing their own money. Such practices not only erode trust but also highlight the malicious intent behind the operations of SWIFT EARNERS.

About SWIFT EARNERS

SWIFT EARNERS markets itself as a registered broker with trading experience spanning 1-2 years. However, this relatively short operational history combined with several red flags raises serious concerns:

Is it Legit?

SWIFT EARNERS operates without regulation, meaning any financial authority does not oversee it. This absence of regulatory oversight significantly increases the risk to investors, as there is no recourse for those who fall victim to its unscrupulous practices.

Physical Addresses

The broker lists two physical addresses: one in San Dimas, California, USA, and another in Bangkok, Thailand. These addresses do little to reassure potential clients, especially considering the international nature of financial fraud and the difficulties in pursuing legal action across borders.

Poor Reputation

Independent review platforms like WikiFX have given SWIFT EARNERS a dismal score of 1.22/10. Such a low rating is indicative of widespread dissatisfaction and multiple reports of unethical behavior.

Suspicious Business Practices

The story of our South African victim is not an isolated incident. SWIFT EARNERS has been reported to engage in several dubious practices:

Unresponsive Customer Service

The victim has reported that once he deposits their money, customer service becomes unresponsive or outright hostile, further complicating any attempts to recover funds.

Conclusion

The case against SWIFT EARNERS is compelling and deeply concerning.

Investors are strongly advised to conduct thorough research and opt for brokers with verifiable regulatory oversight. The allure of high returns should never overshadow the fundamental importance of security and trustworthiness in financial dealings.

In light of these findings, raising awareness and protecting potential investors from falling prey to such schemes is imperative. When choosing a trading partner, always prioritize transparency, regulation, and a solid reputation. If you want more information about certain brokers' reliability, you can open our website. Or you can download the WikiFX App to find your most trusted broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Prices Fall Instead of Rising, Hitting a Two-Week Low

Despite geopolitical tensions, gold prices have dropped sharply, reaching a two-week low. Markets refocus on Fed policy and broader macro trends.

Nigeria to Launch Sweeping Cybersecurity Reforms Amid Rising Digital Threats

With cyber threats escalating and economic losses exceeding ₦250 billion annually, Nigeria is launching comprehensive reforms to safeguard its digital future and build a more resilient cybersecurity infrastructure.

Overlooking Broker Spreads? It’s Costing You More Than You Think

In the ever-competitive world of online trading, where margins are slim and timing is everything, traders often obsess over entry strategies, risk management, and technical setups. Yet one critical element is routinely underestimated, if not outright ignored, especially by retail and novice traders alike, is the broker’s spread.

Reviewing CFreserve - Regulation Status, Operation Period & More

Has CFreserve deceived you financially? Did you face problems regarding forex investment withdrawals with this broker? You’re not alone! Read this exposure story to know how it's duping investors.

WikiFX Broker

Latest News

OneRoyal Expands to Oman, Strengthening Forex Trading in MENA

Govt Imposes Import Curbs on Precious Metal to Stop Liquid Gold Inflow

Reviewing CFreserve - Regulation Status, Operation Period & More

Starlink rival Eutelsat pops 22% as France backs capital raise

The Fed held interest rates steady, but some credit card APRs keep going up. Here's why

Meta, EssilorLuxottica unveil Oakley smart glasses

Important Statement on the Authenticity of WikiFX Score and Broker Reviews

JPMorgan to Launch JPMD Deposit Token

Kroger's shares rise as grocer says shoppers seek lower prices, cook more at home

Circle shares extend their rally after Senate passes landmark stablecoin bill

Currency Calculator