简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

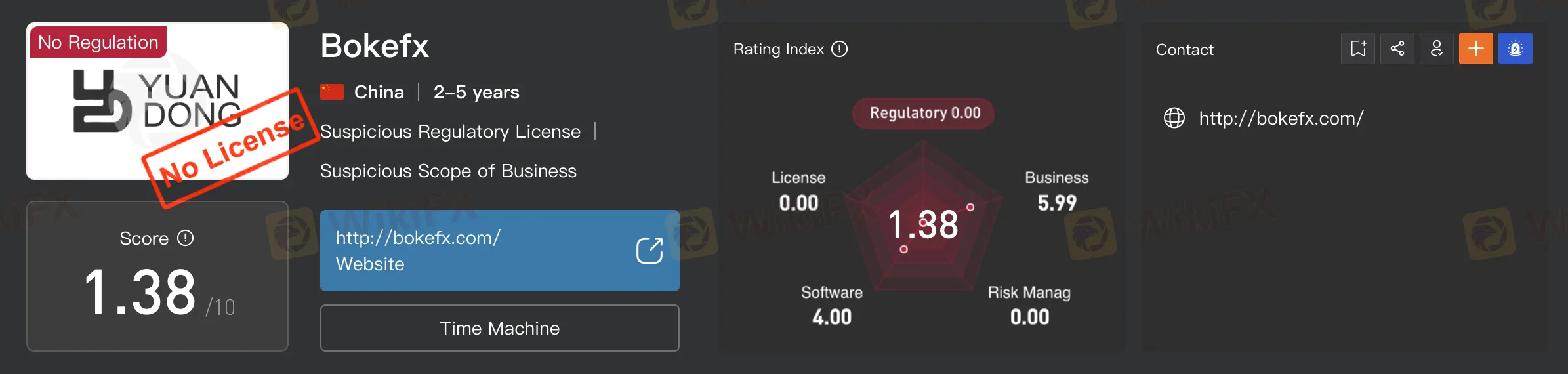

WikiFX Broker Assessment Series | Bokefx: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Bokefx. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of Bokefx. Our aim is to equip readers with essential information needed to make informed decisions about utilizing this platform.

In the realm of online forex trading, identifying potential concerns is vital, and Bokefx has raised some notable issues. Marketed as an online forex broker, Bokefx lacks a crucial element – regulatory authorization. This sets Bokefx apart from reputable competitors, as it operates without the oversight necessary for a trustworthy online trading option.

The absence of regulatory authorization poses a significant problem. Regulatory bodies play a pivotal role in ensuring fair practices, setting standards, and facilitating issue resolution. Without this oversight, traders face potential risks of unethical practices with no proper recourse.

When assessing the legitimacy of a forex broker, the accessibility and reliability of its official website are paramount. Bokefx, however, adds to existing concerns by having its official website, bokefx.com, conspicuously unavailable. A reputable forex broker typically maintains a professional and easily accessible website, providing clients with a centralized platform for crucial information about services, policies, and regulatory compliance. The unavailability of Bokefx's website not only hinders potential traders from accessing vital details but also raises significant questions about the transparency of the broker's operations and the safety of clients' funds.

The sudden unavailability of Bokefx's website raises red flags, deviating from industry norms. Clients rely on brokers to deliver a secure and informative online environment, and the absence of Bokefx's website disrupts this essential aspect of the client-broker relationship. This unforeseen development heightens concerns about the broker's legitimacy, leaving clients uncertain about the safety and whereabouts of their funds. In the competitive forex trading landscape, where trust and transparency are paramount, Bokefx's missing official website cast doubt on its commitment to maintaining open communication and providing a secure trading environment for its clients.

Bokefx's status as an unlicensed and non-regulated online forex broker, coupled with the sudden unavailability of its website, serves as a clear warning to traders. Caution and thorough research are advised before selecting an online trading platform. In an industry where trust and transparency are of utmost importance, Bokefx's current circumstances underscore the significance of choosing brokers with a solid regulatory foundation and a commitment to clear communication and robust customer support.

Hence, WikiFX recommends that users exercise caution and consider exploring alternative brokers with a verified regulatory status from WikiFX's comprehensive database. Download your free WikiFX mobile app now!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Real Story of TriumphFX: How Investors are Losing Millions

Since September 2019, the TriumphFX operation has woven a sophisticated web of deception, ensnaring Malaysian investors with promises of consistent monthly returns between 4% and 7%. Despite assurances of stability, complications emerged when TriumphFX abruptly converted client holdings into cryptocurrency. This unannounced switch eroded confidence and rendered investors unable to access or withdraw their capital.

Webull Pay and Coinbase Join Forces to Offer Better Crypto Trading

Webull Pay has announced a strategic partnership with Coinbase, selecting the US-based crypto giant as its official cryptocurrency partner. The collaboration will leverage Coinbase’s Crypto-as-a-Service (CaaS) platform to deliver enhanced crypto capabilities, underpinned by institutional-grade infrastructure and regulatory compliance.

Over 25 complaints reached! Traders warn you to be aware of the broker BDSWISS

BDSwiss, a forex and CFD broker founded in 2012, is currently under fire from traders across the globe. Despite offering access to over 250 CFDs on Forex, Shares, Indices, Commodities, and Cryptocurrencies with leverage up to 1:2000 and spreads from 0 pips, its credibility is now being seriously questioned.

CMCMarkets Brokers Review

CMCMarkets has played a significant role in the industry for many decades. But does it suit every trader? In today’s article, we will offer you a comprehensive review of this broker so that you can have a close overall look at CMCMarkets.

WikiFX Broker

Latest News

2025 FXPesa Latest Review

Aurum Markets- Opportunity or Trap? Let's uncover

Can these 10 Forex Brokers boost your money in 2025? Saxo, IB, eToro & More

OANDA Japan Deletes Inactive Accounts, Urges Re-registration

Explore the Unique features of Zerodha, BOI & HDFC Bank

WikiFX Broker Assessment Series | IronFX: Is It Trustworthy?

IG Group Set to Smash £1 billion Revenue Mark in FY2025

Stop Wasting Money on FX Courses! Learn Forex for Free- from Top Brokers

High Score, Fully Regulated: 3 Brokers You Can Trust in 2025

Traze Receives Authorization from UAE Securities Regulator

Currency Calculator