简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

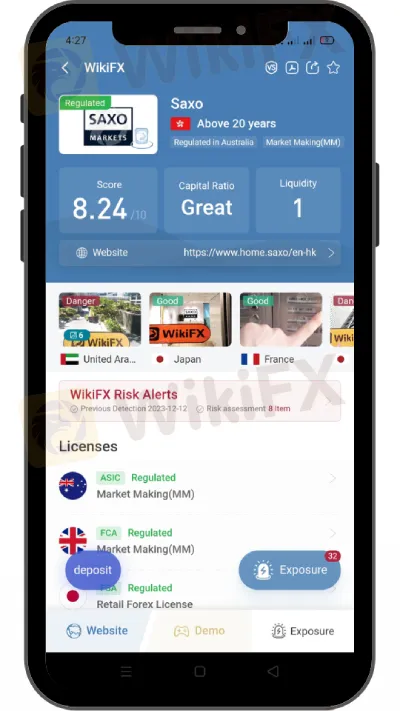

Saxo Bank Japan Cuts Spreads on 7 Major Currency Pairs

Abstract:Saxo Bank Japan reduces spreads on 7 major currency pairs, improving trading efficiency and reaffirming its commitment to superior financial services.

Tokyo, Japan - Saxo Bank Securities Co., Ltd., the esteemed Japanese arm of the global investment giant Saxo Bank, has announced a significant reduction in the spreads of seven widely traded currency pairs, marking a major step forward in forex trading efficiency.

In a move that is set to benefit a broad range of investors and traders, Saxo Bank Japan has adjusted the spreads on these pairs, ensuring more cost-effective trading experiences. This strategic change underscores Saxo Bank's commitment to providing superior trading conditions and underscores its position as a leader in the financial services sector.

The updated spreads are as follows:

USD/JPY (US dollar/yen): 0.2 pips

EUR/JPY (Euro/yen): 0.5 pips

AUD/JPY (Australian dollar/yen): 0.7 pips

GBP/JPY (British pound/yen): 1.2 pips

EUR/USD (Euro/US dollar): 0.4 pips

AUD/USD (Australian dollar/US dollar): 0.6 pips

GBP/USD (British pound/US dollar): 0.9 pips

These changes will be effective during specific trading hours, which are delineated as follows:

Eastern Daylight Time: From 8:00 a.m. Japan time to 4:00 a.m. the following day

Eastern Standard Time: From 9:00 a.m. Japan time to 5:00 a.m. the next day

It is important to note that these fixed spreads are applicable only during the stated target periods. At other times, the spreads will vary according to market conditions.

About Saxo Bank

Saxo Bank Japan is a fully licensed subsidiary of Saxo Bank, a worldwide leader in online trading and investing. Saxo Bank, founded in Denmark in 1992, has extended its services globally, offering a solid platform for trading in FX, stocks, CFDs, futures, funds, and bonds. Saxo Bank Japan maintains this heritage by providing unrivaled access to global financial markets as well as better trading technology suited to the requirements of Japanese customers.

Regulatory Body

Saxo Bank Japan works under the stringent supervision of Japan's financial regulatory authorities, assuring adherence to the highest standards of openness and financial integrity. The regulatory environment in Japan is meant to safeguard investors and preserve the integrity of financial markets, making Saxo Bank Japan a trusted partner for both individual and institutional traders.

Bottom Line

This reduction in spreads by Saxo Bank Japan represents not only an opportunity for traders to engage in forex transactions more cost-effectively but also highlights Saxo Bank's ongoing dedication to enhancing client experiences and fostering accessible global trading environments. With its strong regulatory foundation and commitment to technological innovation, Saxo Bank Japan continues to set the standard for excellence in the world of online trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Thinking of Investing? Read Must-Know Facts About Funding pips!

When you check the internet for Funding Pips, you'd be surprised to know it's filled with praise for Funding Pips but often lacks the real facts that traders need. Everything that seems too good to be true should always be verified first. It could be Fraud . So, we conducted research and collected several facts you must know about Funding Pips.

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

The Enforcement Directorate (ED) in Mumbai has attached assets worth around INR 131.45 crore. This included a luxury yacht and residential properties in Spain. Read this interesting story.

Oil Prices Stay Firm on Solid US Jobs Data

Oil prices stayed firm this week as the US labour department posted a better-than-expected payroll data in June 2025. Read this news in detail.

Truth About Angel One – Here’s What You Need to Know

Thinking about investing in Angel One? Wait! Know the essential things about the broker before Invest. It could be SCAM. Read, think, and invest .

WikiFX Broker

Latest News

Forex Hedging: Is It a Trader’s Safety Net or Just an Illusion?

OPEC+ members agree larger-than-expected oil production hike in August

Top Wall Street analysts are pounding the table on these 3 stocks

Asia-Pacific markets set for mixed open after Trump shifts goalposts on tariffs again

Currency Calculator