简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

BREAKING: Massive Security Breach at Stake.com Results in Losses Exceeding $40 Million

Abstract:Stake.com faces a security breach with over $40M in digital assets stolen. Amid user concerns, the platform assures the safety of funds. Stay updated with WikiFX

Leading cryptocurrency betting platform, Stake.com, faced a severe security breach, resulting in unauthorized transactions from its Ethereum and Binance Smartchain hot wallets. Reports suggest that the platform lost over $40 million in digital assets in this audacious cyber-attack.

Chronology of the Attack

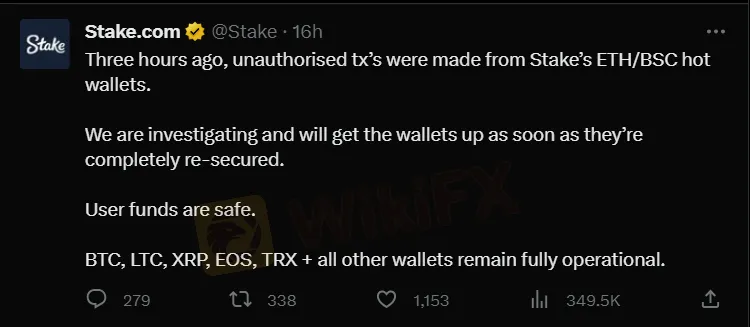

On Sept. 4, Stake.com confirmed that it had detected irregular activity, with unauthorized transactions being made from its ETH and BSC hot wallets. This shocking revelation came after speculations swirled on X (previously known as Twitter) when multiple users raised alarms about possible unauthorized withdrawals.

Zachxbt, a notable online investigator, shared on X that Stake.com could have lost assets up to a staggering amount of $41 million. He further analyzed that hackers initially made away with around $16 million and subsequently siphoned off another batch worth over $25 million.

Stake.com's Response to the Breach

Despite the turmoil, Stake.com was quick to assure its vast user base about the safety of its funds. “We want to assure our customers that their assets and funds are secure,” read a statement from the company on X. The platform went on to clarify that all other wallets, including BTC, LTC, XRP, EOS, and TRX, remain unaffected and are fully operational.

Canadian celebrity, Drake, who endorses Stake.com, has not commented on the incident.

In a conversation with the media, Ed Craven, Stake.com's co-founder, emphasized the platform's precautionary measures. “We always keep a minimal amount in our hot wallets due to such security risks. We are working tirelessly to ensure that the affected wallets are back online soon.”

Curiously, both Craven and Stake.com have refrained from revealing the exact value of the stolen digital assets, raising eyebrows in the crypto community.

The Road Ahead

The hacking incident has once again highlighted the vulnerabilities associated with crypto platforms and the immense importance of stringent security measures. Stake.com announced that a thorough investigation is already in progress, and steps are being taken to further bolster its security infrastructure.

As the world watches closely, the incident serves as a stark reminder for other crypto platforms about the unpredictability and challenges that lie ahead.

Stay informed on this developing story and more with the WikiFX App. For the latest updates, download here: https://www.wikifx.com/en/download.html.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

You need to know this if you are losing money in forex trading!

If you’re losing money in forex trading, you’re far from alone: data from major brokers show that approximately 70 % to 80 % of retail Forex traders end up losing money. This article explores the most common reasons behind trading losses and provides actionable strategies to help you turn your losing streak into a learning opportunity rather than a financial drain.

Japan Issues Urgent Warning on $700M Unauthorized Trades

Japan's FSA warns of $700M in unauthorized trades from phishing attacks on brokerage accounts. Cybersecurity threats continue to rise in the country.

Tradu Joins TradingView for Seamless CFD and Forex Trading

Tradu, a global trading platform, integrates with TradingView for seamless CFD and forex trading, offering transparency, tight spreads, and fast execution.

Asian Scam Operations Worth €35 Billion Spreading Globally, UN Warns

The UN report reveals the growing threat of transnational crime, driven by AI, money laundering, and scams across Asia, Africa, and Latin America.

WikiFX Broker

Latest News

FCA Issues Alerts Against Unauthorised and Clone Firms in the UK

Consob Orders Blackout of 9 Fraudulent Financial Websites

eXch Exchange to Shut Down on May 1 Following Laundering Allegations

How a Viral TikTok Scam Cost a Retiree Over RM300,000

FCA Proposes Simplifying Investment Cost Disclosure for Retail Investors

JT Capital Markets Review

Fresh Look, Same Trust – INGOT Brokers Rebrands its Website

Tradu Joins TradingView for Seamless CFD and Forex Trading

Japan Issues Urgent Warning on $700M Unauthorized Trades

Beware of Gold Bar Investment Scams: Rising Threats

Currency Calculator