简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ATFX And PCFA Formulate Strategic Banking Alliance In Pacific Islands

Abstract:ATFX partners with PCFA and Tongan reps for a strategic alliance, aiming to bolster Pacific Islands' financial foundations through a regional bank. A focus on unity, growth, and cultural respect.

ATFX, a leading global fintech brand under AT Capital Group Limited, has recently entered into a significant agreement with the Pacific China Friendship Association (PCFA) and representatives from Tonga. This agreement, a Memorandum of Understanding (MOU), aims to solidify a strategic partnership.

The main objective of this MOU is to pave the way for AT Capital's potential investments in establishing a regional bank. This move aims to strengthen the financial foundation of Pacific Island nations. The bank would focus on improving the regional financial sector's efficiency and backing development projects. These projects include investment, trade, and infrastructure development in the region.

PCFA and Tongan representatives play a pivotal role in introducing AT Capital to the Tongan market, subsequently extending its reach to the broader Pacific region.

This initiative sets a new milestone in the Pacific's financial sector. It aligns with the Maritime Pearl Road's ideals, which is an extension of the Belt and Road Initiative. This collaboration seeks to utilize PCFA's network to improve the banking infrastructure of Pacific countries, starting with Tonga.

The partnership aims to tailor investment strategies that respect Pacific cultures. It also seeks to elevate the Pacific financial system's standards, focusing on Blue & Green economies, poverty reduction, climate change solutions, the One Blue Pacific Principle, and the 2050 Blue Pacific Continent Strategy. These focus areas highlight the unity and shared goals of Pacific island nations.

Mr. Joe Li, Chairman of AT Capital, expressed his optimism, stating, “There's a lot of untapped potential in Tonga and its neighboring Pacific countries. Our goal is to ensure the Pacific region grows freely and peacefully, creating a resilient environment of harmony, security, and prosperity for everyone.”

On the other hand, Dr. Hiria Ottino, PCFA's President, said, “Our partnership with AT Capital is a proud moment for us. PCFA is committed to the welfare of Tonga and other South Pacific countries. We're eager to support the region's economic growth in sectors like tourism, fisheries, and agriculture.”

AT Capital, globally acclaimed and multi-award-winning, offers its services in various languages, serving clients from Europe, Asia, Latin America, the Middle East, and the Pacific.

The PCFA, a non-political NGO, was founded in 2016 by Princess Royal, Her Royal Highness Princess Salote Mafileo Pilolevu Tuita of Tonga. The organization, which has 21 members, addresses regional challenges and individual member country priorities.

About AT Capital:

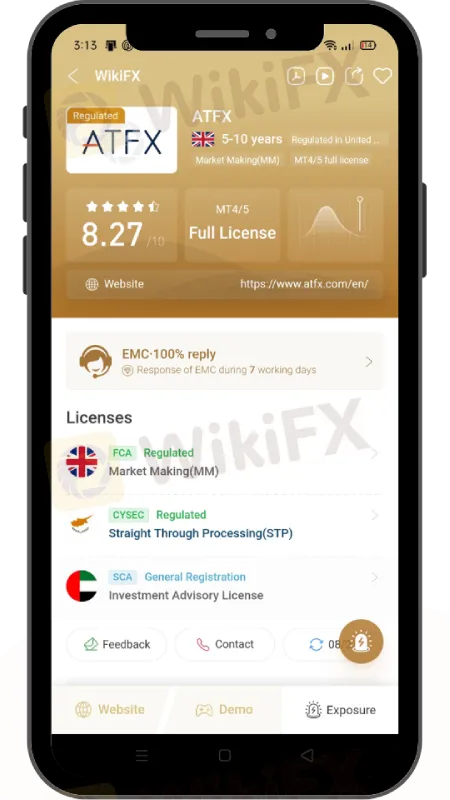

Renowned worldwide, AT Capital houses the ATFX brand. Licensed in several countries, including the UK, Cyprus, UAE, and Australia, ATFX operates in 15 regions globally. Apart from offering top-notch trading services, the company also provides detailed economic reports and monitors global market trends.

Visit the ATFX WikiFX dealer page to access the official URL of ATFX.

Link: https://www.wikifx.com/en/dealer/5121914749.html

For the latest updates, download the WikiFX App on your smartphone. Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top Reasons Why FXCM is Your Go-to-Broker for Forex Trading

A revered broker name is what you want to associate with being a forex trader. Fortunately, you have plenty of such names on WikiFx where the best forex brokers and regulators are listed to ensure your transaction is genuine. One such name is FXCM, a regulated forex broker in the United Kingdom (UK). Let’s check out more details about FXCM through this article.

Scammers Use AI to Fake Lim Guan Eng’s Support for Investment Scheme

A fake video showing former Penang Chief Minister Lim Guan Eng promoting an investment scheme has started spreading online. Lim has come forward to say the video is not real and was made using artificial intelligence (AI).

IronFX: A Closer Look at Its Licences

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about IronFX and its licenses.

Spot vs Forward Contracts - Which Should You Choose?

Mulling foreign exchange contract options - Spot vs Forward - to begin or consolidate your trading journey? Read this comprehensive guide explaining the differences between spot and forward contracts. You can select better using it.

WikiFX Broker

Latest News

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

OctaFX Flagged by Malaysian Authorities

OctaFX and XM Trading Platforms to Be Blocked in Singapore

ATFX Opens New Office in Cape Town's Portside Tower to Expand in Africa

Tighter Scrutiny: Finfluencers Face Global Crackdown Amid Rising Risks

IronFX: A Closer Look at Its Licences

2025 Broker Real - World Reviews: Share Your Insights & Grab Thousands in Rewards!

Eid ul Adha Celebration Continues – Grab the STARTRADER Offer Now!

Nonfarm Data Lifts Market Sentiment, U.S. Stocks Rebound Strongly

Interactive Brokers Enhances PortfolioAnalyst with New Features

Currency Calculator