简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

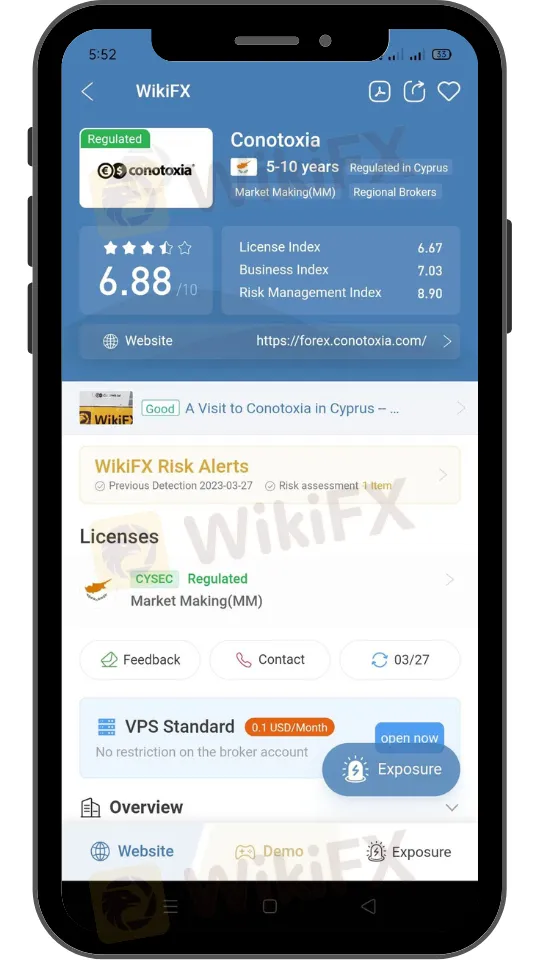

Retail Traders to Benefit from Conotoxia's Investment Advice Offering

Abstract:Conotoxia, the retail trading arm of Poland-based fintech Cinkciarz, has launched an investment advisory service with no entry barriers and a low threshold. It is the first company in the forex and contracts for the different industries to offer the product on a large scale. The service is available to retail traders from Europe and will provide individual investment recommendations on selected financial instruments.

Conotoxia, a retail trading platform under the Polish fintech company, Cinkciarz.pl, has launched a new investment advisory service with a low entry threshold for retail traders in Europe. The service provides individual investment recommendations on selected financial instruments and is available to traders without entry barriers and a minimum capital threshold. Conotoxia believes that this new service could revolutionize how retail brokers build their offerings.

Individualized Investment Advice for Retail Traders

Conotoxia is the first company in the foreign exchange (FX) and contracts for difference (CFD) industry to offer this product to traders on a large scale. The advisory service is not based on simple recommendations for the general public but is tailored to the needs of individual clients, the size of their portfolios, and their risk profiles. The investment advisor identifies opportunities and recommends appropriate moves, but the investor has complete control over the creation of their investment portfolio.

Accessible Investment Advice for European Retail Traders

Conotoxia's investment advice is aimed at European retail traders, specifically from the European Economic Area, including European Union countries, Iceland, Liechtenstein, and Norway. The service will be accessible via paid subscriptions, but the broker has prepared a promotion for users who sign up before June. They will have the chance to try the investment advice for free for a one-month trial period.

Conotoxia CEO, Grzegorz Jaworski, stated that the investment advisory service is a significant step in the development of the Invest & Forex segment and that the knowledge and experience of advisors can help clients build their own professional investment portfolios and make informed decisions. The company unveiled the new service at the Invest Cuffs 2023 conference held in Poland last weekend.

Expanding the Accessibility of Investment Advisory Services

Conotoxia wants to popularize investing with the support of professional advisors and make such services available to small investors. The company believes that investment advice could change individual investors' approach to investing. By providing investors with options to invest independently or with the support of an investment advisor, Conotoxia gives clients a broader package of services than its competitors.

About Conotoxia

Conotoxia is a Polish financial technology business that offers a variety of services such as foreign currency conversion, money transactions, payment handling, and internet dealing. Its currency conversion tool accepts a broad variety of currencies, including main currencies like USD, EUR, GBP, and JPY, as well as many foreign currencies. The website is simple to use and enables customers to conduct transactions swiftly and simply, with the option of locking in currency rates for future purchases.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download the app: https://social1.onelink.me/QgET/px2b7i8n

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why Do Malaysians Keep Falling for Money Games?

Malaysia has seen a persistent rise in money game schemes, luring thousands of unsuspecting investors with promises of high returns and minimal risk. These schemes operate under various disguises, from investment clubs to digital asset platforms, yet they all follow the same fundamental principle—new investors fund the profits of earlier participants. Once the cycle collapses, the majority are left with devastating losses. Despite repeated warnings and high-profile cases, many Malaysians continue to fall victim. What drives this phenomenon?

Axi Review 2025: How to Open An Account & Withdraw Money ?

Launched in 2008, Axi (formerly Axitrader), is an Australia-registered online forex broker that has gained solid development these years. Globally and heavily regulated, the Axi brand has several entities operating under different jurisdictions, including ASIC in Australia, FCA in the UK, CYSEC in Cyprus, FMA in New Zealand, and DFSA in the United Arab Emirates. Axi gives investors the opportunity to enter some popular markets with small budgets, including Forex, Metals, Indices, Commodities, Cryptocurrency, particularly IPOs, using its advanced software—the Axi Trading platform (newly launched), Copy Trading App, MT4, MT4 Webtrader . With no cost during account setup, traders can choose from 3 tailored live accounts in addition to a demo account. Among many forex brokers, Axi stands out due to its user-friendly interface, which allows for quick and simple account opening and withdrawals.

How to Start 2025 Strong in Forex: February Market Insights

As we step into February 2025, the global Forex market is already showing signs of movement that traders can harness for profitable opportunities. With the start of a new year, it's the perfect time for both new and experienced traders to set clear goals, refine strategies, and position themselves for success. In this article, we’ll explore the key market trends, economic events, and actionable strategies that can help you start 2025 strong in Forex.

The Best Forex Pairs to Trade in February 2025

As we enter February 2025, Forex traders are looking ahead at the key currency pairs that will offer the most potential for profit, based on economic events, market sentiment, and geopolitical factors. In this article, we’ll explore the best Forex pairs to focus on this month, considering expected volatility, upcoming events, and fundamental market shifts.

WikiFX Broker

Latest News

Woman Scammed Out of RM200,000 in Investment Fraud

XS.com Launches AI Insights to Transform Trading Behavior

Why Do Some Brokers Block Your Withdrawals?

FCA Cautions Against ALT-COINFX

Robinhood Halts Super Bowl Betting Contracts After CFTC Request

3-Day Online Scam Trap: Victims Lose $200K—Don't Be Next!

Japan's January PMI has been released, investors need to pay attention to these points!

Investment Scam on Telegram: How a Woman Lost Over RM65,000

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Currency Calculator