简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

eToro's Improved Economic Calendar

Abstract:The online broker eToro is adding new elements to its Economic Calendar in order to give its customers even more useful data.

The Consumer Price Index (CPI) statistics, which monitors inflation by estimating the average shift over time in the costs of products and services usually bought by families, are now included in the schedule. This is a fantastic resource for dealers to keep up with market patterns.

The Economic Calendar on eToro will also include interest rate choices and times for market holidays, which has been a highly desired tool by customers. This demonstrates that eToro constantly listens to its customers and works to offer the features and tools they require.

The option to view ETF payout days is a fantastic addition to the Economic Calendar. For individuals who depend on profits as a source of money, this option is particularly helpful.

It's important to remember that in December 2022, eToro published a unique Economic Calendar on its website. This feature makes it possible for traders to view the times of earnings reports for particular companies in their inventory, which is very beneficial for making wise investment choices.

Simply select “Economic Calendar” from the primary left-side option by clicking or tapping on it. You can view all forthcoming earnings report deadlines for the companies in your account from there. The schedule also offers other crucial details like ex-dividend days and payout dates.

How to Use the Economic Calendar to Improve Your Forex Strategy

The foreign exchange market, or forex market, is influenced by economic events like central bank policy decisions, economic data releases, and geopolitical events. To trade forex successfully, traders need to use an economic calendar to stay informed and adjust their trading strategy accordingly. Here are some tips for using an economic calendar to improve your forex strategy:

Understand the impact of economic events

Monitor the calendar regularly

Use the calendar to plan your trades

Pay attention to market expectations

By following these tips, traders can make informed decisions and reduce their trading risks, ultimately improving their chances of success in the forex market.

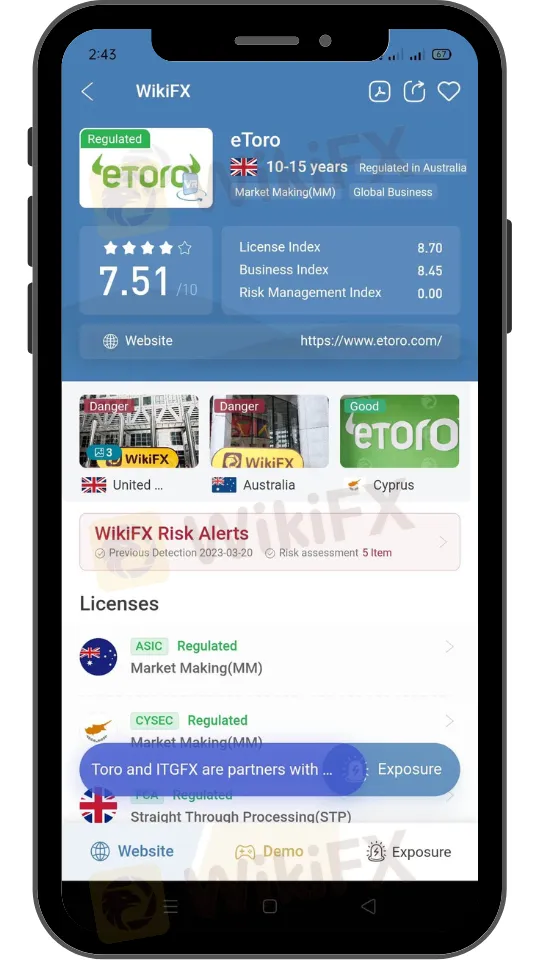

Install the WikiFX App on your smatphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Oil Prices Slide After Cease-Fire

Oil markets tumbled on renewed geopolitical signals and market anxieties as both Brent crude and West Texas Intermediate (WTI) futures plunged over 5% following a fragile cease-fire agreement between Iran and Israel and a surprising comment from the U.S. President regarding Chinese imports of Iranian oil.

A Guide to RBI Forex Rules in India

To ensure transparency, the Reserve Bank of India (RBI), which regulates the country’s foreign exchange market, places certain rules on buying and selling currencies and other transactions.

Can cryptocurrencies be regarded as mortgage collateral?

The U.S. Federal Housing Finance Agency (FHFA) has issued a directive to mortgage giants Fannie Mae and Freddie Mac to begin evaluating cryptocurrency holdings as part of mortgage risk assessment criteria.

J.P. Morgan Active High Yield ETF Launched with $2 Billion Investment

J.P. Morgan's JPHY ETF launch brings a $2B active fixed income ETF, targeting high-yield debt securities and benchmarked to the ICE BofA US High Yield Constrained Index.

WikiFX Broker

Latest News

Gold Prices Down in Early Hours of Spot Trading Today in India

Purple Trading Penalized €150,000 Over Compliance Failures in Cyprus

Tiger Brokers Expands Hong Kong Operations to Tap Offshore Chinese Wealth

FXTM: A Closer Look at Its Licences

U.S. Treasury yields rise after Trump announces Israel-Iran ceasefire

eToro UK Launches 4% Stock Cashback Card: Earn Up to £1,500 Monthly

Watch Out: FCA Issues New Warning List of Scam Firms

Google Issues Stark Warning: Cybercrime Losses to Hit $13.8 Trillion by 2028

EBC Expands ETF CFD Offering & Copy Trading Education Partnership

European defense stocks jump 1% as world leaders meet for NATO summit

Currency Calculator