简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Rate Outlook: Retesting 2019 Lows, Eyes on NFP Report

Abstract:Gold Rate Outlook: Retesting 2019 Lows, Eyes on NFP Report

Gold Price Analysis and Talking Points:

黄金价格分析和谈话要点:

Gold Prices Edging Lower Since FOMC, Eyes on NFP

自FOMC以来黄金价格走低,关注NFP

{4} 自FOMC以来黄金价格走低,关注NFP {4}

Gold Rate Technical Analysis | Topside Resistance Holds, Retest of 2019 low

黄金价格技术分析|上行阻力位,重新测试2019年低点

See our quarterly gold forecast to learn what will drive prices throughout Q2!

请参阅我们的季度黄金预测,了解将在第二季度推动价格的因素!

Gold Prices Edging Lower Since FOMC, Eyes on NFP

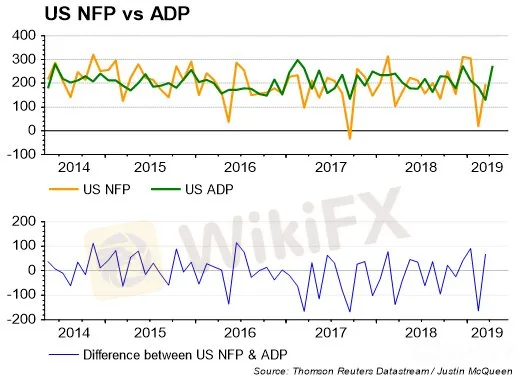

Gold prices have continued to edge lower since the FOMC meeting with the precious metal now eying a retest of the 2019 low ($1266). Fed Chair Powell had poured cold water on the idea of a rate cut, after stating that inflation drop had been due to “transitory” factors, consequently, bond yields have been tracking higher since the meeting, while gold prices have continued to edge lower. On the data front, eyes will be on todays NFP report, in which the risk is for an upside beat following strong ADP data, as such, another robust NFP report could push gold to fresh 2019 lows. However, as has usually been the case, focus will be on the wage components as the FOMC look for inflationary pressures.

黄金价格继续走低,因为FOMC与贵金属的会议目前正在重新测试2019年的低点(1266美元)。美联储主席鲍威尔对减息的想法倾注了冷水,因为通货膨胀下降是由于“暂时性”因素造成的,因此,自会议以来债券收益率一直在走高,而黄金价格继续走低。在数据方面,人们将关注今天的非农就业报告,其中风险是在强劲的ADP数据之后出现上行风险,因此,另一份强劲的非农就业报告可能推动金价升至2019年的新低。然而,正如通常的情况一样,焦点将放在工资成分上,因为FOMC会寻找通胀压力。

Gold Rate Technical Analysis | Topside Resistance Holds, Retest of 2019 low

黄金价格技术分析|上行阻力位,重新测试2019年低点

Last week we had noted that failure to at the 61.8% Fibonacci retracement could spark a retest of the 2019 low (full story), which in turn keeps the near-term outlook for gold modestly bearish. A fresh 2019 low brings the 50% Fibonacci retracement ($1262) in focus, however, the uptrend from the 2018 low is holding for now.

上周我们注意到未能达到61.8%的斐波那契回撤位可能引发对2019年低点的重新测试(全文),其中转而使黄金的近期前景略微看跌。新的2019年低点带来50%斐波纳契回撤位(1262美元),然而,2018年低点的上升趋势暂时持续。

GOLD PRICE CHART: Daily Time-Frame (Mar 2018-May 2019)

黄金价格表:每日时间框架(2018年3月 - 2019年5月)

--- Written by Justin McQueen, Market Analyst

---由市场分析师Justin McQueen撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Fed Rate Cut Calls, Would NFP Tilt The Odds?

The latest data for the U.S. ISM Manufacturing PMI, released on August 1, 2024, shows a decline to 46.8, down from 48.5 in June. This marks the sixth consecutive month of contraction (a reading below 50) and remains well below the historical average of 52.88. On July, the Bank of Canada (BoC) announced a 25-basis-point cut in its benchmark interest rate, reducing it to 4.5%. This was the second consecutive rate cut, following a similar move in June. The latest ADP Nonfarm Employment Change for..

Quiet Before the Storm? Markets Poised for a Relaxed Week

For June 2024, Canada's CPI rose by 2.7% year-over-year, down from 2.9% previously. This decrease in core inflation is driven by a combination of slower economic growth and moderated wage growth, even with a strong labor market. The FOMC meeting minutes from July 2024 indicated that the Federal Reserve decided to maintain the federal funds rate within the target range of 5.25% to 5.50% and revealed a shift in the Fed's focus. The latest data on U.S. Initial Jobless Claims, for the week ending...

Weekly Economic Calendar: Key Events Impacting USD, JPY, GBP, EUR, and Gold (XAU)

This week's economic calendar is packed with key events affecting USD, JPY, GBP, EUR, and Gold (XAU). In the USA, watch for Core PCE Price Index, ISM Manufacturing PMI, Initial Jobless Claims, and JOLTs Job Openings. Japan releases the Tankan Large Manufacturers Index and Services PMI. The UK focuses on Manufacturing and Construction PMI, while the Eurozone releases CPI and Services PMI data. Each event's potential impacts on currencies and gold are analyzed for market insights.

Rate Cut Hopes on the Line: NFP Set to Steal the Spotlight!

The US ISM Manufacturing PMI came in at 48.7 for May, below the forecast of 49.8 and the previous reading of 49.2. The main reasons for this stagnant reading are ongoing weak demand, which affects supplier orders, inventories, capital investments, and employment. In May, ADP Nonfarm Employment Change have increased 152,000 jobs, which was below the forecast of 173,000 and down from the previous month's 188,000. The US ISM Non-Manufacturing PMI for May exceeded expectations, registering 53.8...

WikiFX Broker

Latest News

Top Wall Street analysts are upbeat about these dividend-paying stocks

Singapore's economy grows 4.3% in second quarter, beating expectations

What WikiFX Found When It Looked Into Emar Markets

MT4 vs MT5 Which Forex Trading Platform Fits Your Needs in 2025?

Stock futures slide on more Trump tariff letters, but are off worst levels of session: Live updates

Short or Long Term: Which to Choose for Double-Digit Returns from Gold Investments?

Gold Soars Above $3,350 as XAU/USD Rallies on Trade Tensions

Asia-Pacific markets trade mixed as investors assess Trump's latest tariff threats; bitcoin hits new highs

What is Forex Trading Simulator?

Switzerland tourism boosted as women's soccer continues record-breaking rise

Currency Calculator