简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Brushes Off Positive Eurozone Inflation Ahead of US Nonfarm Payrolls

Abstract:EURUSD continues its downtrend despite positive Eurozone inflation figures as traders eye for nonfarm payrolls to consolidate a direction. Higher inflation figures are common during the Easter month causing a seasonality effect.

EUR talking points

EURUSD awaits key US data to consolidate a direction

Eurozone inflation moves higher

The Euro failed to regain support from the release of Eurozone CPI figures after trading softer throughout most of the Asian session. EURUSDs downtrend continued after figures revealed annual inflation rate in the Euro area increased to 1.7% in April, up from 1.4% in March, slightly higher than the 1.6% expected. Core inflation, which excludes volatile prices of energy, food, alcohol and tobacco, and is the figure the ECB uses for its policy decision, was 1.2% in April (Expt. 1.0%).

But despite better than expected inflation figures providing potential for a short rebound, EURUSD continues to trade near year-lows registered earlier in the week on the back of a less-dovish stance from the Feds meeting on Wednesday May 1. The pair is still trading below the 1.12 handle as traders wait for nonfarm payrolls figures, due to be released at 13.30, to consolidate a direction. A stronger than expected jobs report has the potential to reignite the prevailing EURUSD downtrend.

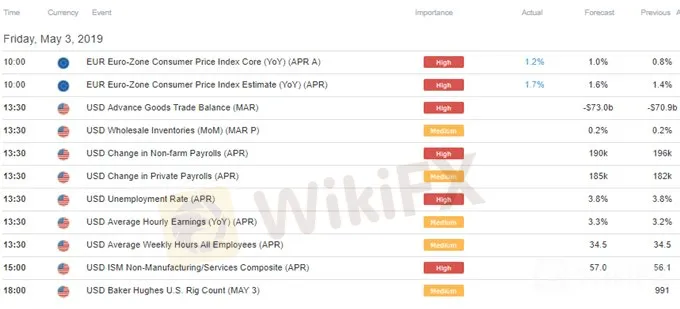

DAILYFX ECONOMIC CALENDAR – EURUSD

DailyFX Q2 Euro Forecast

EURUSD PRICE CHART: 1-MINUTE TIME-FRAME (INTRADAY – MAY 3, 2019)

EUROZONE INFLATION

It is common for inflation to increase in the month that Easter holidays take place, especially if they fall towards the end of the month, as an increase in demand for package holidays, restaurants and hotels pushes prices higher. But keeping in mind that the Easter effect is a seasonality, inflation figures for the following months need to continue on the upside for the ECB to shift to a more hawkish stance.

As a recap of recent Eurozone data, manufacturing PMI figures released yesterday showed that figures for Spain, Italy and France were improving whilst Germany figures disappointed. Overall European Manufacturing PMI was revised upward from 47.8 to 47.9 in April, showing a small recovery from its 80-month low of 44.1 recorded in March. European CPI released today is in line with German CPI figures released on Tuesday Apr 30, showing inflation for the month of April beat expectations by 0.5 percentage points, from 1.5% expected to 2%.

IG Client Sentiment – Retail trader data shows 67.4% of traders are net-long with the ratio of traders long to short at 2.07 to 1. In fact, traders have remained net-long since Apr 12 when EURUSD traded near 1.12763; price has moved 0.9% lower since then. The number of traders net-long is 0.5% lower than yesterday and 14.7% higher from last week, while the number of traders net-short is 9.2% higher than yesterday and 20.4% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

XTB Hack 2025: Major Security Breach Exposes Client Accounts

These are America's 10 weakest state economies most at risk in a recession

These are America's 10 strongest state economies best prepared for a recession

Federal Reserve quietly responds to Trump administration attacks over renovation

Tariff Windfall Drives Surprise $27 Billion US Budget Surplus In June

Top Wall Street analysts are upbeat about these dividend-paying stocks

Singapore's economy grows 4.3% in second quarter, beating expectations

Global week ahead: Trade tensions cloud earnings and the G20 heads south

Want to Succeed in Forex? Start with the Right Trading System

XTB Hack 2025: Major Security Breach Exposes Client Accounts

Currency Calculator