简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD on the Brink of Range Breakout, EURUSD & GBPUSD suffer - US Market Open

Abstract:USD on the Brink of Range Breakout, EURUSD & GBPUSD suffer - US Market Open

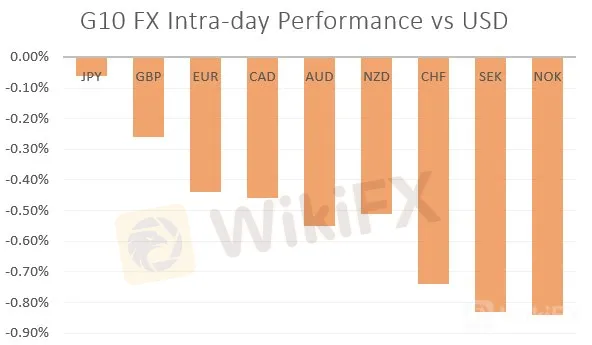

MARKET DEVELOPMENT – USD on the Brink of Range Breakout, Euro & GBP suffer

USD: Given the drop in FX volatility, the USD has continued to benefit, which in turn is now eying the top end of its multi-month range. Consequently, the push higher in the greenback saw Euro test support at the 1.12 handle, while GBP made a firm break below the 1.30.

Crude Oil: Oil prices remain firm as market participants continue to digest yesterday‘s announcement by the US to bring an end to Iranian oil waivers. However, gains have been somewhat modest throughout today’s session with Saudi Arabia talking up the possibility of boosting oil production in order to keep the oil market stable and thus keeping a lid on oil price spikes.

Gold: With the renewed bid in the greenback, gold prices were once again on the backfoot with the precious metal testing support at $1267. The outlook remains bearish in the short run with a break below $1262 opening up a move towards $1250.

Source: Thomson Reuters, DailyFX

DailyFX Economic Calendar: – North American Releases

IG Client Sentiment

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Rush Again: What's Driving the Bullion Market Crazy Ahead of US Jobs Data?

Gold prices rebounded on July 1 owing to a declining US dollar and mounting concerns over US trade tariffs. Investors resorted to the yellow metal as key US economic and policy data is about to be made public.

Eye on Today’s U.S. GDP

Nvidia's highly anticipated earnings report was released yesterday, but despite the numbers beating market consensus, the performance lacked a "wow" factor for investors. As a result, the market seemed to have already priced in the earnings, leading to a decline in all three major indexes on Wall Street. Despite yesterday's technical correction, Nvidia's strong earnings suggest that the tech industry remains robust, with ongoing demand for Nvidia's chips potentially driving future gains

Gold Price Tops $2500 For the First Time

Gold prices soared above the $2,500 mark for the first time, driven by expectations of potential interest rate cuts, which have weakened the dollar to its recent low levels. Market participants are now focused on Wednesday’s FOMC meeting minutes for insights into the Fed’s next monetary policy moves.

Economic and Political Shifts Impact Global Markets Part 2

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

WikiFX Broker

Latest News

Alchemy Markets Review 2025: Key Facts and Insights

Largest Market Makers

Temasek's portfolio scales new peak even as divestments hit over 2-decade high

Exposing Trade Capital Limited - Siphoning Millions, Restricting Withdrawals, Charging Extra Fees

GMI Edge: A Closer Look at Its Licenses

How Do I Place a Stop-loss Order?

5 Serious Warnings About Mirrox! You Can’t Afford to Ignore

FXPRIMUS: 5 Things They Don’t Want You to Know

Manual vs. Automated Forex Trading: Which One Should You Choose?

Mining firms lift FTSE 100 to record high after Trump confirms 50% copper tariff

Currency Calculator