简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stocks Hit Record Highs on Fed Hopes, Tariff Watch

Zusammenfassung:U.S. stock indices surged to fresh all-time highs on Thursday, lifted by strong corporate earnings from Nvidia, Taiwan Semiconductor, and Netflix. The rally extended across major benchmarks, with both

U.S. stock indices surged to fresh all-time highs on Thursday, lifted by strong corporate earnings from Nvidia, Taiwan Semiconductor, and Netflix. The rally extended across major benchmarks, with both the Nasdaq Composite and S&P 500 closing at record levels.

Tech-led optimism continued to drive market momentum, with investors largely shrugging off global trade concerns and instead focusing on signs of potential Fed easing in the months ahead.

Fed Officials Send Mixed Signals on Rate Path

Markets found support in comments from Fed Governor Christopher Waller, who voiced his backing for a potential 25-basis point rate cut in July, citing slowing labor market momentum and lingering downside risks to growth. He noted that the recent uptick in inflation appears largely tariff-driven and may prove transitory.

In contrast, New York Fed President John Williams struck a more cautious tone, suggesting the full economic impact of tariffs has yet to materialize. He emphasized the importance of upcoming data—including July PPI and core PCE—in guiding the Feds next moves.

Trade and Tariff Outlook: Focus Turns to Smaller Nations

On the trade front, President Trump hinted at potential 10–15% tariffs on imports from over 150 smaller economies. Formal notifications are reportedly underway, underscoring that tariff risks remain a central driver of global market sentiment.

Markets are now closely watching for international responses—particularly from the EU, Canada, Mexico, and possibly Japan and South Korea—ahead of this weekends G20 Finance Ministers Meeting. Any sign of retaliation or diplomatic friction could revive volatility.

Market Sentiment: Resilient but Vulnerable

Despite the reemergence of tariff threats, equity sentiment remains firm. Investors appear to have priced in the near-term impact of tariffs, focusing instead on corporate performance and monetary policy.

“Markets were largely unmoved by the latest tariff rhetoric, suggesting that traders have already digested much of the impact,” said Shawn Lee, Senior Market Analyst at Ultima Markets.

“However, if upcoming actions exceed expectations or tensions escalate heading into the August 1 tariff deadline, we could still see significant volatility,” he added.

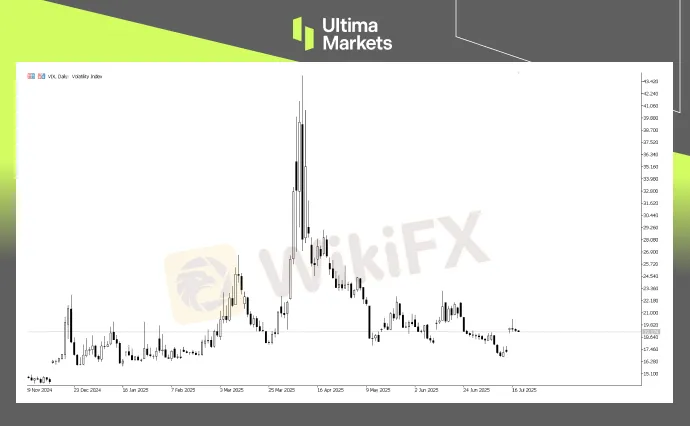

CBOE Volatility Index | Source: Ultima Market MT5

The CBOE Volatility Index (VIX) remains near historically low levels, signaling broad market calm. However, it edged slightly higher this week—potentially reflecting a degree of profit-taking or precautionary hedging by investors following the strong rally in equities.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Wechselkursberechnung